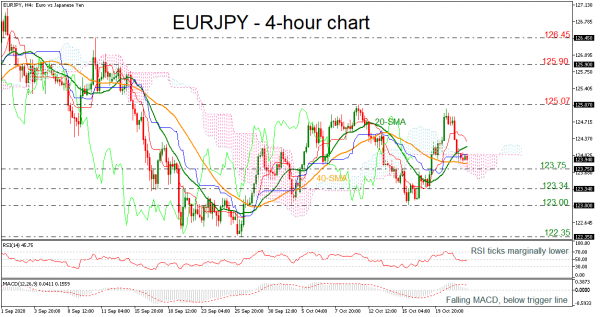

EURJPY has been in a downside tendency over the last sessions, holding within the Ichimoku cloud and the short-term simple moving averages (SMAs). The RSI indicator is losing momentum beneath the 50 level, while the MACD is falling below its trigger line. Also, the red Tenkan-sen line is pointing down and the blue Kijun-sen line is moving sideways, suggesting fading upward momentum.

In the event of a downside reversal below 123.75, the 123.34 support level and the 123.00 psychological mark may ease the selling pressure. Failure to bounce off the latter could bring the 122.35 barrier into view.

Alternatively, a climb above the 20-period SMA could take the market until the 125.07 resistance, taken from the high on October 9. Further gains could lead the pair until 125.90 and 126.45, switching the neutral bias to bullish.

In the bigger picture, the market continues to head sideways over the last three weeks. A drop below 123.00 would disturb the consolidation area of 123.00-128.07, shifting the outlook to bearish. Otherwise a jump above 125.07 could send signals for some gains.