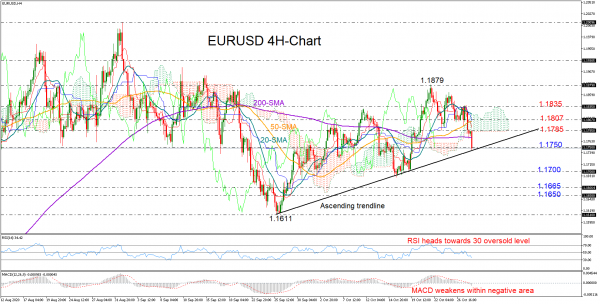

EURUSD is fast approaching the ascending trendline that has been navigating the market since the bounce on the 1.1611 ground as the Ichimoku cloud on the four-hour chart blocked the way to the upside and the 200-period simple moving average (SMA) failed to catch the fall.

With the price trading below its SMAs, the RSI decelerating towards its 30 oversold level, and the MACD strengthening its negative momentum below its signal and zero lines, the short-term bias is seen skewed more to the downside than to the upside. Still, whether the decline could get new legs may depend on the trendline. If it fails to add floor this time, the sell-off may speed up towards the 1.1700 barrier, while lower, some consolidation may commence within the 1.1665-1.1650 zone before all attention shifts to the 1.1611 bottom.

In the positive scenario where the trendline holds firm, the bulls may attempt to crawl above the 1.1785 border and into the cloud. If those efforts prove successful, the 50-period SMA could halt the bullish action from reaching the resistance region around 1.1835. Beyond that, traders will be looking for a decisive close above the 1.1879 peak to increase buying exposure.

In brief, EURUSD is exposed to downside risks, though traders may wait for a close below the upward-sloping trendline before increasing selling interest.