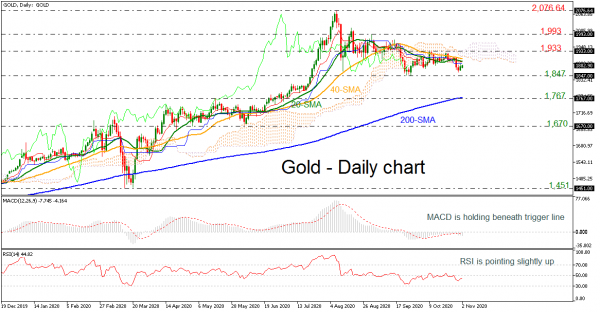

Gold prices have been in a slightly descending mode after they reached the 2,076.64 barrier in August. The price is currently holding beneath the 20- and 40-day simple moving averages (SMAs) and the Ichimoku cloud. The MACD oscillator is confirming this bearish bias as it stands beneath its trigger line, however, the RSI is pointing marginally up in the negative territory.

Immediate support could come from the 1,847 level before the bears drive the yellow metal even lower towards the 1,767 barrier, which coincides with the 200-day SMA. More downside pressure could send the market until the 1,670 hurlde, taken from the trough on June 5.

If there is an attempt above the moving averages, the next target could be the 1,933 line, which stands within the Ichimoku cloud. A break above this obstacle could open the door for the 1,933 and the 2,076.64 strong levels.

Summarizing, gold prices seem to be in a bullish tendency in the long-term timeframe and in a bearish structure in the short-term view. A jump above 2,076.64 could change the recent decline back to positive one.