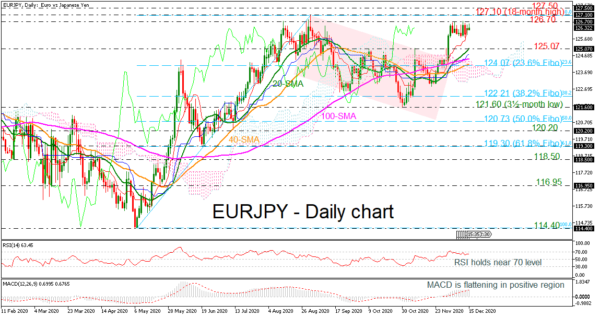

EURJPY is struggling to gain positive momentum after its fast run above the descending channel and the 125.07 barrier, stalling around the 126.70 resistance.

The downside reversal for the 70 level in the RSI and the slowdown in the MACD oscillator justify the diminishing buying pressure, though, both remain well above their neutral thresholds keeping the short-term term risk skewed to the upside. In trend indicators, the bullish cross within the 20- and 40-day simple moving averages is still an encouraging signal.

A close above the 126.70 barrier will brighten the broader outlook, pushing the price towards the 18-month high of 127.10, which has been frequently tested during September ahead of 127.50. Beyond that, the rally may gear up to the 129.30 line, taken from the peak on December 2018.

Should selling forces strengthen, the 125.07 support, which overlaps with the 20-day SMA would come under the spotlight. The 23.6% Fibonacci retracement level of the 114.40 to 127.10 up leg at 124.07 is coming next, ahead of the 38.2% Fibonacci of 122.21. Moving lower, the three-and-a-half-month low of 121.60 could initially turn support to keep bias on the positive side.

To sum up, EURJPY is facing a weaking bullish bias, where a drop below 121.60 is expected to enhance selling interest.