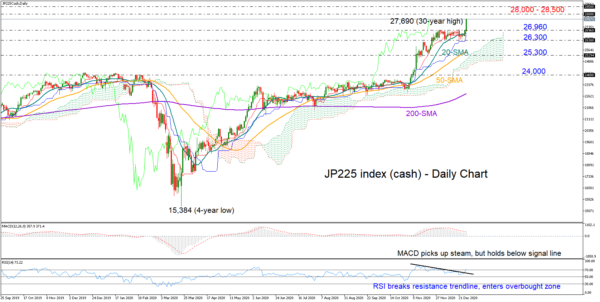

Japan’s 225 stock index (cash) staged a stunning rally before the year end, accelerating above the tough 26,960 ceiling of the one-month old consolidation phase and towards a 30-year high of 27,690.

The 28,000 – 28,500 psychological area will be closely watched in the short run as the RSI is flagging a bullish bias following the breach of a descending trendline. Yet, the indicator has already crossed above its 70 overbought mark, while the MACD could not surpass its red signal line despite rebounding, both hinting some caution over the price momentum.

If sellers come into play, the 26,960 resistance region should switch to support to keep the short-term outlook positive. Failure to do so could bring the lower boundary of the range around 26,300 under the spotlight as any violation at this point could confirm another negative extension towards the 25,300 barrier.

Meanwhile in the bigger picture, the market maintains a positive trajectory above 24,000.

Summarizing, Japan’s 225 index is expected to trade cautiously bullish in the short term, likely finding the next obstacle within the 28,000 – 28,500 zone.