Key Highlights

- GBP/USD traded towards 1.3700 before correcting lower.

- A key resistance trend line protected gains above 1.3700 on the 4-hours chart.

- EUR/USD climbed higher sharply after testing the 1.2200 support zone.

- Gold price started a fresh surge after it broke the $1,900 resistance zone.

GBP/USD Technical Analysis

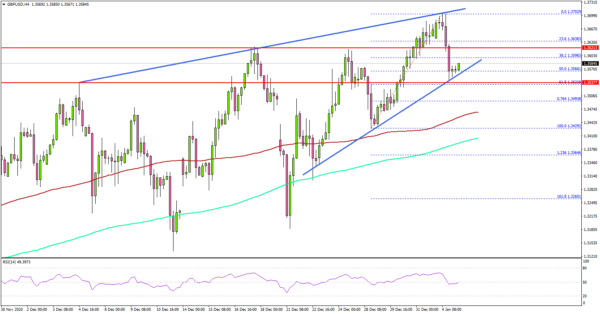

The British Pound extended its rise above the 1.3600 and 1.3650 levels against the US Dollar. GBP/USD traded to a new multi-month high at 1.3702 before correcting lower.

Looking at the 4-hours chart, the pair failed to gain pace above the 1.3700 zone. Besides, it seems like a key resistance trend line protected gains above 1.3700. The pair corrected lower and traded below 1.3600.

It even broke the 23.6% Fib retracement level of the upward move from the 1.3429 swing low to 1.3702 high. On the downside, the first key support is near the 1.3540 zone (the recent breakout zone).

There is also a connecting bullish trend line forming with support near 1.3560. If there is a downside break below the trend line and 1.3550, the pair could extend its decline below the 1.3540 level.

The next major support could be 1.3490 level or the 76.4% Fib retracement level of the upward move from the 1.3429 swing low to 1.3702 high. Any more losses could lead GBP/USD towards 1.3480 or the 100 simple moving average (red, 4-hours).

On the upside, the 1.3700 level is a strong resistance. A clear break above the 1.3700 level could set the pace for more upsides towards the 1.3750 and 1.3800 levels.

Fundamentally, the UK Manufacturing PMI for Dec 2020 was released yesterday by both the Chartered Institute of Purchasing & Supply and Markit Economics. The market was looking for a stable reading of 57.3.

The actual result was above the market forecast, as the UK Manufacturing PMI climbed higher to 57.5 in Dec 2020.

The report added:

The UK manufacturing sector had a mixed end to 2020. Clients bringing forward orders to beat the end of the Brexit transition period and the ongoing bounce from the re-opening of the global economy boosted inflows of new orders and pushed output higher.

Looking at EUR/USD, there was a sharp increase after the pair tested the 1.2200 support zone. Similarly, gold price rallied above $1,900 and $1,920 resistance levels.

Economic Releases

- Germany’s Unemployment Change for Dec 2020 – Forecast 10K, versus -39K previous.

- Germany’s Unemployment Rate for Dec 2020 – Forecast 6.2%, versus 6.1% previous.

- US ISM Manufacturing PMI for Dec 2020 – Forecast 56.5, versus 57.5 previous.