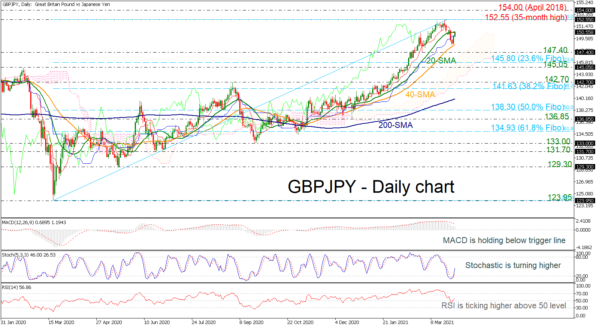

GBPJPY is edging higher again after the rebound off the 40-day simple moving average (SMA) and is approaching the 20-day SMA, which is acting as strong resistance around 150.60.

The momentum indicators are confirming the recent bullish movement. The MACD is holding below the trigger line but it looks ready to tick up, while the stochastic posted a bullish crossover in the oversold territory and the RSI is jumping above the neutral-threshold of 50.

A successful attempt above the 20-day SMA could take the pair towards the 35-month high of 152.55, reached in March 18 before flirting with the 154.00 handle, achieved in April 2018. More increases could send the bulls to retest the high from January 2018 at 156.50.

Alternatively, a dive beneath the 40-day SMA could meet the 147.40 support ahead of the 23.6% Fibonacci retracement level of the up leg from 123.95 to 152.55 at 145.80 before slipping to 145.05. Steeper losses could see the 142.70 barrier and the 38.2% Fibonacci of 141.63, while traders may plunge towards the 200-day SMA currently around the 140.00 psychological level.

Overall, GBPJPY has been in an ascending tendency since March 2020 and in case of declines below the 200-day SMA may open the way for a neutral bias.