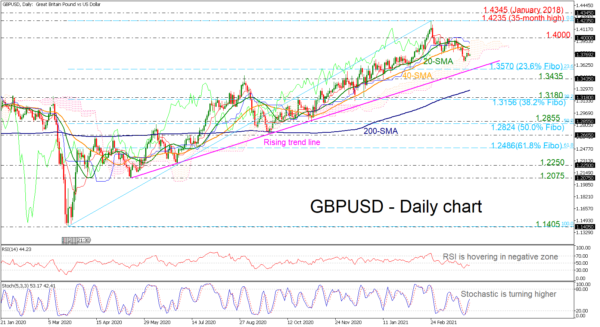

GBPUSD is falling following the pullback off the 35-month high of 1.4235 and is hovering beneath the bearish crossover within the 20- and 40-day simple moving averages (SMAs). The technical indicators are showing mixed signals as the RSI is pointing down in the negative area, while the stochastic is heading north.

The downside move could take the price towards the long-term ascending trend line and the 23.6% Fibonacci retracement level of the upward wave from 1.1405 to 1.4235 at 1.3570. Steeper decreases could open the door for the 1.3435 ahead of the 200-day currently at 1.3280.

A rise above the short-term SMAs could take the investors until the 1.4000 handle before touching the mutli-month peak of 1.4235 and the high from January 2018 at 1.4345.

Summarizing, GBPUSD is bearish in the near term, though, in the bigger picture is still in a bullish tendency.