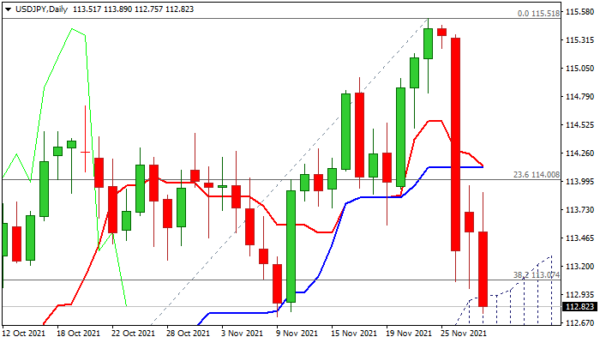

Bears resume on Tuesday after a double rejection at pivotal Fibo support at 113.07 (38.2% of 109.11/115.51).

The latest comments from drugmaker Moderna’s CEO that Covid-19 vaccines were unlikely to be as effective against the new Omicron variant as they have been against the Delta version, raised concerns in the market and further boosted the risk aversion.

Fresh extension of the pullback from 115.51 (2021 high, posted on Nov 24) penetrated thick daily cloud (top of the cloud lays at 112.93), and pressure pivot at 112.72 (Nov 9 trough) generating initial bearish signal.

The near-term action is weighed by last Friday’s massive bearish candle, while bearish momentum is gaining pace on daily chart and MA’s forming bear-crosses, adding to negative outlook.

Today’s close below 112.72 would confirm strong bearish signal and open way for test of next key supports at 112.31 (50% retracement) and 111.90 (daily cloud base), violation of which would confirm reversal and open way for a deeper correction.

Res: 112.93, 113.07, 113.89, 114.00.

Sup: 112.31, 112.07, 111.90, 111.56.