EUR/USD

Current level – 1.1298

The euro started the first trading day of the year with losses. The bulls continue to experience serious difficulties around the 1.1360 zone, and the pair was heavily sold out yesterday afternoon. After the false breach of the resistance at 1.1360, a probable scenario is for the bearish pressure to continue towards the lower band of the range at 1.1236. Market sentiment is still mixed and a confirmed breach of either zone would define the future direction of the market. The bulls can expect the first local support to be at around 1.1278. This week is shaping up to be quite a busy one, with the U.S. ISM manufacturing index being expected today at 15:00 GMT, the FOMC meeting minutes being scheduled for Wednesday at 19:00 GMT, and the non-farm payroll report for the U.S. being expected on Friday at 13:30 GMT.

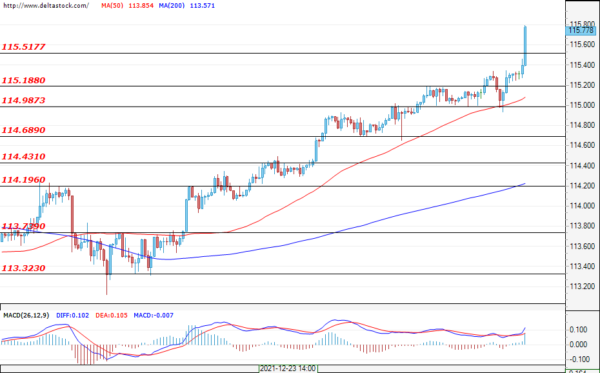

USD/JPY

Current level – 115.77

The market is in a strong uptrend and, in the early hours of today’s trading, the pair managed to overcome the resistance at 115.51 that was coming from the higher time frames. While maintaining a strong start of the week, the Ninja is likely to test the area at around 116.00 and even at 117.00. The market seems stretched at the moment and so deep pullbacks are not yet ruled out. The first unconfirmed support for the bulls is 115.51 and a more significant area is the one at 114.98.

GBP/USD

Current level – 1.3475

The bulls managed to reach the resistance at 1.3500, but failed to keep the pressure going. The market is entering a corrective phase and prices are likely to retest the supports at 1.3454 and at 1.3390. It is likely that any trading activity in the coming days will remain in the range between 1.3550 and 1.3390. An increase in activity can be expected today following the announcement of the manufacturing PMI for the UK at 9:30 GMT.

EURGERMANY40

Current level – 16035

The German index started the new year with some good gains as the bulls tested the resistance at around 16070. The first support for them is the zone at 15975, followed by the more significant one at 15830. The uptrend seems strong and, so far, no deep corrections have been noted. If this optimism is maintained, then a breach above 16070 and a new rally towards 16260 is expected. Possible retracements should remain limited above 15830. Today at 8:55 GMT investors expect the unemployment change data for Germany and any positive news on this front could contribute towards a new upward impulse.

US30

Current level – 36568

The first trading day for the year came with a bang for the U.S. blue-chip index, which closed at a new record high. The index managed to form solid support at around 36230 and, in the early hours of today, prices have gravitated around the resistance at 36580. Should market sentiment remain positive, a breach and a continuation of the rally towards 36900 could be expected. Given the overstreched and overbought levels of the market, deeper pullbacks are not excluded. If the support at 36230 is violated, then a test of the lower zone at 35900 could also be expected.