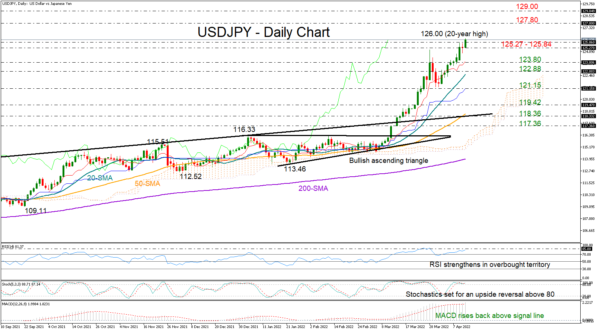

USDJPY bulls returned on Wednesday to fight the key 125.27 – 125.85 region after a neutral day, with the price even touching an almost two-decade high of 126.00.

The positive trajectory in the momentum indicators endorse the bullish action in the market, though with the RSI and the Stochastics hovering in the overbought region for a week now, a downside correction would not be a big surprise in the short term.

Nevertheless, a decisive close above the 125.85 bar could confirm additional buying activity likely towards the 127.80 – 129.00 constraining zone last seen in April 2002. Higher, the next obstacle could pop up around 130.50 taken from the first quarter of 2002.

Alternatively, for the bears to come back into play, the price will need to drift below the 125.27 barrier. In this case support could initially develop within the 123.80 – 122.88 territory, where the 20-day simple moving average (SMA) is converging. Should sellers persist, the limits around 121.15 may attempt to block any sharper declines towards the 119.42 – 118.36 zone. Still, only a continuation below 116.33 would downgrade the broad positive outlook in the market.

All in all, USDJPY may keep attracting buying interest in the coming sessions, especially if the price manages to claim the 125.85 bar, though some caution is warranted as the price is trading in an overbought zone.