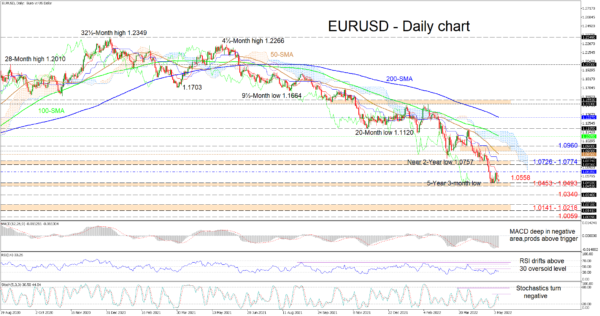

EURUSD is tiptoeing around more than five-year low levels and the pair’s efforts to improve seem to be to no avail, leaving no fingerprint of clear gains as the bearish bias overwhelms. That said, the falling simple moving averages (SMAs) are endorsing the downward trajectory in the pair.

Currently, the downward sloping Ichimoku lines are indicating that the sellers are active, while the short-term oscillators are now transmitting mixed messages in directional impetus. The MACD is reflecting easing in negative momentum as the stochastic oscillator is promoting additional descending moves in the pair. Meanwhile, the RSI is hovering in the bearish region, above the 30 oversold mark.

In the negative scenario, the 1.0453-1.0493 support band may try to delay for a while longer the revival of the broader descent in the pair. However, if selling pressures intensify, the price may meet the January 2017 trough of 1.0340 before aiming for the 1.0141-1.0218 support section that extends all the way back to mid-July 2002. Should the heavy pair sink past this barrier too, the bears could then attack the December 2002 low of 1.0059 opening the door for the parity mark.

Otherwise, if buyers create positive traction off the 1.0453-1.0493 multi-year low boundary, upside friction could commence from the falling red Tenkan-sen line at 1.0558 ahead of the March 2020 trough (previous support-now-resistance) of 1.0635. Slightly higher, the 1.0726-1.0774 resistance band could then test buying power, a barrier referring to the April until mid-May 2020 period of lows. Creeping further up, the bulls may encounter the approaching 50-day SMA at 1.0856 ahead of the 1.0900-1.0960 resistance border.

Summarizing, EURUSD is sustaining a sturdy bearish bearing beneath the SMAs and the 1.1185 high. A break below the 1.0453-1.0493 support may nudge positive developments further into the horizon. Yet, for optimism to return in the pair, the price would need to step over the 1.0900-1.0960 obstacle and the Ichimoku cloud.