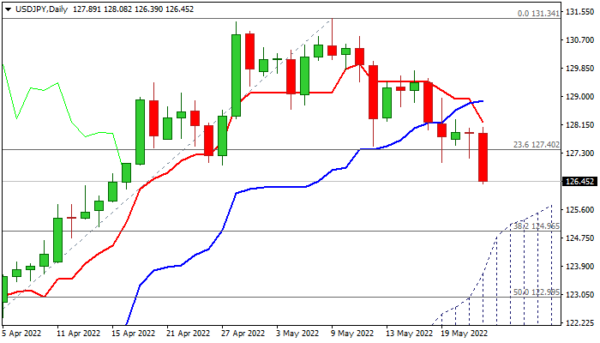

Bears tightened grip on Tuesday after being congested in past three days, sending the pair to five-week low and signaling an extension of corrective pullback from new 20-year high (131.34).

Profit-taking after strong bullish acceleration in past two months (the pair was up 13% in Mar/Apr) contributed to the recent easing, also signaled by a double-top pattern on daily chart.

Falling daily Tenkan-sen crossed below Kijun-sen, adding to negative signals, generated on break of a double-Fibo supports at 127.40 zone (23.6% of 114..64/134.34 / 38.2% of 121.27/131.34 upleg) and rising bearish momentum.

Bears eye key supports at 114.96/77 (Fibo 38.2% of 114.64/131.34/ top of rising and thickening daily cloud0 where stronger headwinds could be expected, while break here would sideline larger bulls and open way for stronger correction.

Near-term bias is expected to remain with bears while the price action stays below broken Fibo support at 127.40.

Res: 126.94; 127.02; 127.40; 128.22

Sup: 126.31; 125.23; 124.96; 124.77