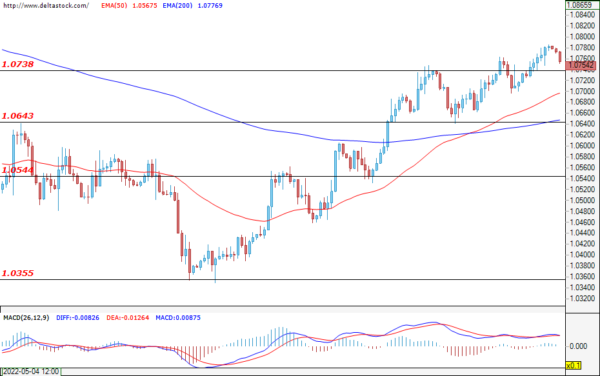

EUR/USD

The bulls managed to breach the resistance at 1.0738, and during the early hours of today`s trading session, the pair is trading above the mentioned zone. A confirmation of the breach could lead to a more sustained rally of the euro against the dollar and a move towards the upper target at 1.0825. If the bullish momentum fades, then the bears could test the support at 1.0643. А successful breach for them could deepen the decline towards the next zone at 1.0544 and could lead to change in the current short-term positive sentiment of the market participants. The most important news for today is the EU CPI due at 09:00 GMT, which could rise well above 8%, signalling the ECB that it might have to become much more aggressive in its efforts to curb inflation.

USD/JPY

After the bulls prevailed during yesterday’s trading session, the dollar recovered some of its recent losses against the yen and the pair tested the resistance zone at 128.05. If the bullish attack continues, then a confirmation of the breach could easily lead to a continuation of the rally and a test of the zone at 129.45. If the bears re-enter the market, then a violation of the support zone at 127.31, followed by a successful test of the lower level at 126.43, would mark the current move as corrective and would most likely strengthen the negative expectations for the future path of the currency pair.

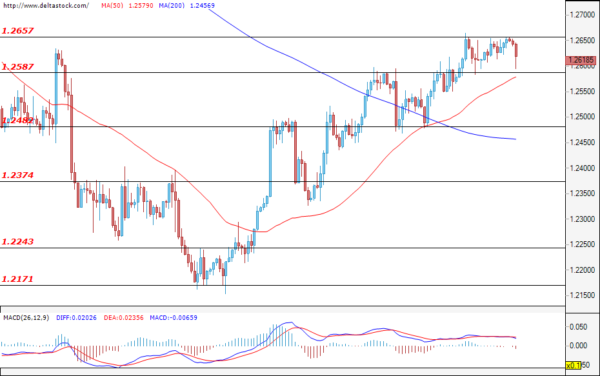

GBP/USD

The resistance zone at 1.2657 withheld the bullish attack, and during the early hours of today`s trading, the Cable consolidated around the current level at 1.2612. At the time of writing, a new attempt for a breach of the aforementioned level is the most likely scenario, but only a successful violation could lead to new gains for the sterling against the dollar and a move towards the resistance from April 2022 – the zone at 1.2770. The first support can be found at the level of 1.2587, followed by the lower support at 1.2482.

EUGERMANY40

The sentiment remained unchanged, and after the positive start of the trading week, the EUGERMANY40 is now trading just under the resistance zone at 14580. A successful breach of the mentioned level for the bulls would strengthen the positive expectations for the future path of the index and could easily lead to new gains and continue the rally towards the upper important zone at 14800. Worse-than-expected unemployment change data for Germany (today; 07:55 GMT) could help the bears to enter the market. Their first target is expected to be the support at 14237, followed by the lower level at 14099.

US30

The rebound of the world’s leading markets for a second trading day led to a massive rally for the American index, and after the test of the resistance zone at 33457, the price consolidated just below it. A new attack for the buyers and a successful breach of the zone at 33457 could easily lead to new gains and could pave the way for a test of the important resistance at 34070. If the bullish momentum fades, then the bears could head the index for a test of the support at 32701. A violation of the lower target at 31969 could lead to a change in the current short-term positive sentiment of the market participants.