GBPUSD edged higher to fully recoup yesterday’s soft decline after news the British Prime Minister Boris Johnson will resign later in the day.

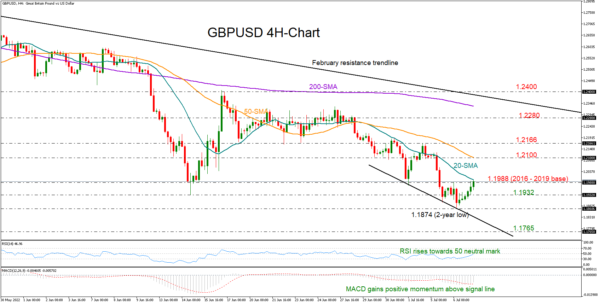

The short-term outlook, however, is still discouraging as the bearish trend is well intact below June’s high of 1.2400.

In momentum indicators, the upturn in the RSI and the MACD on the four-hour chart, shows improving market sentiment, but buyers may not show engagement unless the price overcomes the support-turned resistance zone of 1.1988 and surge above the 20-period SMA. If this scenario unfolds, bullish pressures could intensify towards the 50-period SMA at 1.2100, while higher, a decisive step above the 1.2166 barrier could prompt a sharper increase up to the 1.2280 resistance.

If the 1.1988 boundary blocks the way higher, with the price decelerating below June’s trough of 1.1932 too, the bears may retest the new two-year low of 1.1874 before heading towards the 1.1765 barrier, taken from March 2020.

In short, GBPUSD has not fully escaped negative risks despite the ongoing bullish correction. That said, a decisive close above 1.1988 could motivate fresh buying.