EUR/USD

After reaching a parity, the single european currency managed to recover some of the lost positions against the U.S. dollar, but during the past week, neither the bulls, nor the bears were able to dominate the market and we witnessed a formation of a range movement in the narrow channel between 1.0120 – 1.0270. There is plenty of economic news this week that could be a factor in setting a clearer direction for the currency pair. Among the most anticipated news will be the release of the U.S. consumer confidence data (Tuesday; 14:00 GMT), the U.S. Fed interest rate decision (Wednesday; 18:00 GMT), U.S. gross domestic product data (Thursday ; 12:30 GMT), as well as the announcement of the Eurozone inflation rate (Friday; 09:00 GMT) and also Eurozone GDP data, again on Friday, at 09:00 GMT.

USD/JPY

The USD/JPY correction deepened at the end of the last week, with the bears managing to lead the market towards the support area at 136.00. At the time of writing, the currency pair is on the verge of a test of the mentioned level and a successful breach could give the bears the necessary incentive to attack the next levels around 135.00, followed by the one at 134.00. The main economic news that could affect the volatility of the currency pair and the sentiment of investors is mentioned in the analysis of EUR/USD, with the most significant being the announcement of the U.S. Fed interest rate decision, which in turn could lead to a renewed appreciation for the dollar.

GBP/USD

The pound, like the euro, has been in a range since the beginning of last week, with neither the bulls, nor the bears managing to prevail. The trade is limited between the levels 1.1890 – 1.2031. The plethora of economic news coming this week could paint a clearer picture of the future of the currency pair. The main resistance for the bulls is the level at 1.2030 and the main support is the level at 1.1760.

EUGERMANY40

The appreciation of the German index during the past week was limited to the resistance level at 13426. The subsequent depreciation could be softened as a corrective phase, as the bears repeatedly failed to prevail and breach the main support at 13095. The current week is abundant with important economic news that could lead to increased volatility for the index, as well as the delineation of a clearer direction. A deepening of the sell-off on the possible breach of the lower limit of the outlined range between 13095 – 13426 will lead to a test of the next significant area before the bears at 12939.

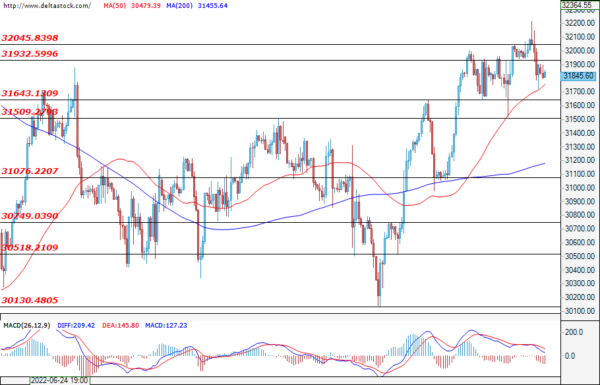

US30

The U.S. blue-chip stock index failed to break through the resistance at 32045 at the end of last week. The subsequent decline cannot be considered complete until the bears test the support level at 31643. On the other hand, a successful breach at this level might as well deepen the sell-off towards the next significant area around 31076. Investors are eagerly awaiting the economic news mentioned in the EUR/USD analysis, which will be a major factor in the movement of the index this week. Increased volatility is expected, especially around the announcement of the U.S. Fed interest rate decision (Wednesday; 18:00 GMT).