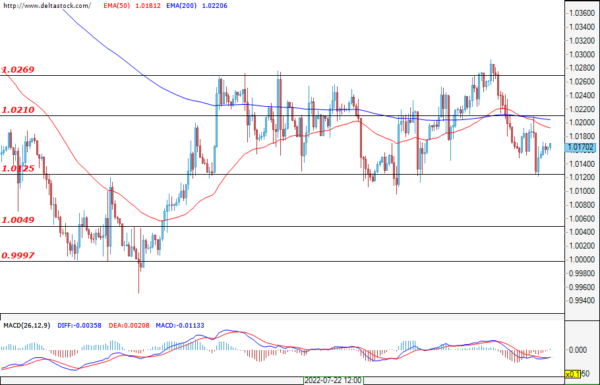

EUR/USD

The bulls again suffered a setback at the 1.0270 resistance and the euro once more sank back to the key support of 1.0125. During yesterday’s session, the pair formed local resistance at 1.0210. Expectations remain negative and prices are likely to break out of the range and to subsequently test the 1.0050 – 1.0000 zone. The market remains in a downtrend and the current range can be interpreted as a pause for the bears, rather than an attempt to reverse the direction of the trend. The resistance at 1.0270 acts as a wall and breaching it is rather difficult at the moment, since in order for that to happen, there would first need to be a significant improvement in the macro environment. Today, increased activity can be expected around the release of initial jobless claims data for the U.S. at 12:30 GMT.

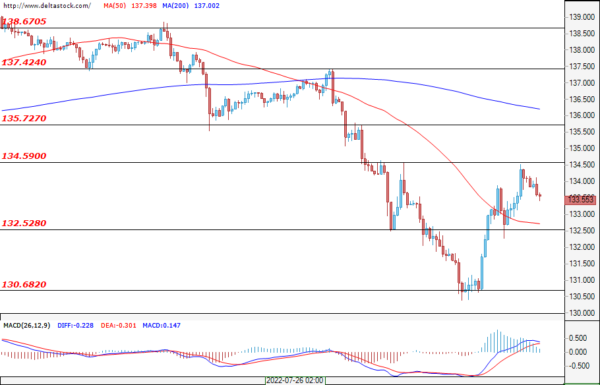

USD/JPY

The decline in the USD/JPY belongs to the higher time frames. The daily support at 130.70 sparked bull interest and prices bounced back sharply, reaching the resistance at 134.60. It is possible that the recovery of the dollar will continue, with the first support for the day being the area at around 132.52. If the bulls slow down the pressure, then the market will be more likely to enter a range than to decline below the level of 130.60. In the event 134.60 is breached, the next targets could be 135.70 and 137.40, respectively.

GBP/USD

The Cable snapped its winning streak and is currently trading at last week’s levels. An interest rate hike by the Bank of England is expected today and volatility is anticipated to be high. A decision is expected at 11:00 GMT, with the pair likely to sell off heavily on a signal that the bank will not do enough to tackle inflationary pressures. First support for the day is 1.2100, followed by 1.2020. First resistances for the bulls are the key level at 1.2180 and the one at 1.2270. It is possible that when the news is released, prices will also reach the next zone at 1.2330, but a rally above it is unlikely.

EUGERMANY30

The German index turned green for the week, with prices currently being on the verge of testing the resistance at around 13670. First supports for the bulls are 13500, 13340, and 13120. The resistance at 13670 comes from the higher time frames and a breach of this area would unlock the possibility of further gains, with a potential target for the rally being levels of around 14000. Given the dire situation in Germany, this rally is more technical than driven by expectations of economic recovery and corporate earnings growth. The market moving into a range will be an initial signal for new massive sell-offs.

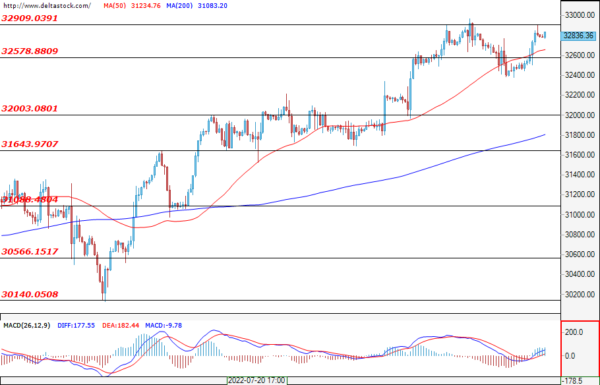

US30

The U.S. blue chips are up nearly 9% since the middle of last month. The speed and aggressiveness of the move are characteristic of a bear market rally. The gains are fragile, but they manage to confuse investors – the old bears have long since been liquidated, the new ones are fueling the market, funds employing different strategies are forced to chase higher prices, and all of this is happening in an environment with extremely poor liquidity. Growth is expected to slow around the resistance zone at 33100. First resistance for the day remains 32910, while the first support is 32580, followed by the level at 32000. Despite the huge gains scored so far, expectations remain negative. A likely scenario is that the market will move into a range, with the main downtrend continuing afterwards.