EUR/USD

The slightly better-than-expected U.S. CPI data helped the bulls prevail and the European common currency rallied against the U.S. dollar. The pair tested the resistance zone at 1.0356, and during the early hours of today`s trading, the price is hovering around the current level at 1.0301. If the buyers` attack continues, then a new attempt at and a successful breach of the mentioned zone could strengthen the positive expectations for the future path of the EUR/USD and could easily lead to a recovery towards the levels at around 1.0490. If the bears enter the market instead, then their first target can be found at 1.0268. A violation of the lower support at 1.0268 could deepen the correction and could pave the way for a test of the major zone at 1.0119. Important news for investors today is the scheduled announcement of the initial jobless claims data (today; 12:30 GMT).

USD/JPY

After the sharp decline yesterday, which was limited to the zone at 132.00, the Ninja recovered some of its recent losses. At the time of writing the analysis, the price is consolidating above the zone at 132.50. A breach for the bulls at the resistance level at 133.45 could easily lead the pair to a test of the next target at 134.40, but only a violation of the level at 135.35 could result in a change in the current sentiment of the market participants and a recovery towards the high at 137.42. If the bears re-enter the market, then a new attempt at and a breach of the support at 132.50 could easily deepen the decline and could lead to the pair reaching the low at 130.68.

GBP/USD

As with the other major currency pairs, the dollar depreciated and the Cable tested the levels from the beginning of August at around 1.2238. If the price remains limited above the zone at 1.2186, which is now acting as a support, then the expectations would be for a new attack on the resistance at 1.2238. A violation here could easily lead to a continual recovery towards the upper target at 1.2291. If the bears manage to prevail and breach the mentioned zone at 1.2186, then the follow-up deeper correction could be limited to the support at 1.2134, followed by the lower level at 1.2063.

EUGERMANY40

The positive sentiments remained unchanged and the German index tested the resistance zone at 13733. A confirmed breach for the bulls could easily lead to new gains and continue the rally towards the psychological level at 14000. The first support for the bears is the zone at 13616, followed by the lower target at 13507.

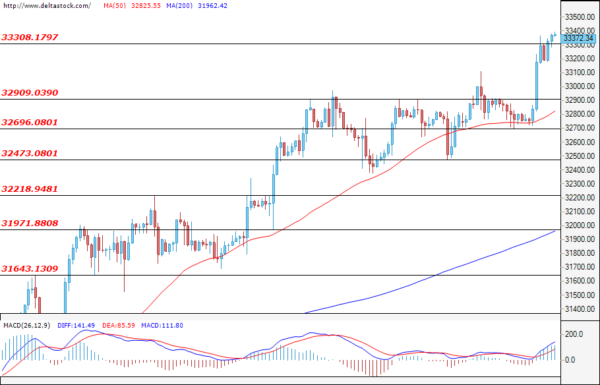

US30

The U.S. index appreciated in value, and after the successful violation of the resistance at 32909, followed by the breach of the upper target at 33309, the price held positions around the current level at 33372. If the bulls continue to prevail, then they could head the index towards the highs from May 2022 at around 14170. Worse-than-expected initial jobless claims data in the U.S. (today; 12:30 GMT) could help the bears to enter the market. A successful test of the support zone at 32909 could lead to a deeper correction and an attack on the lower support at 32475.