EUR/USD

The single European currency is trying to stop its depreciation against the U.S. dollar and has been moving in a range between 1.0089 and 0.9901 for the past five days. While attempts by the bulls to settle more permanently above the resistance at 0.9999 are not particularly successful for the time being, the bears cannot gain the upper hand in their attempts to overcome the support at 0.9901, either. Despite the struggles to form a consolidation, the downward movement cannot be said to be over just yet. Economic indicators that may influence the course of today’s session is the U.S. consumer confidence data at 14:00 GMT.

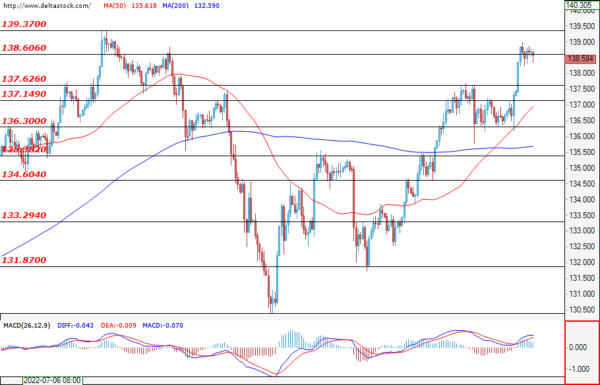

USD/JPY

In the past session, the yen continued to lose ground against the dollar and headed towards the resistance at 136.60. A possible breach of the next important resistance at 139.37 would give the bulls an even more serious advantage, but if the price does not hold above it, then we could witness a double top and a downward movement, which would weaken the currency pair’s current trend.

GBP/USD

The bears failed to overcome the support formed at 1.1649, but this does not necessarily mean that they have given up all hope. The bulls need to breach at least three important resistances – 1.1725, 1.1792 and 1.1855 – before it could be said that they have achieved any temporary success at all. Sentiment remains negative and the bears are likely to head south and breach the support at 1.1648.

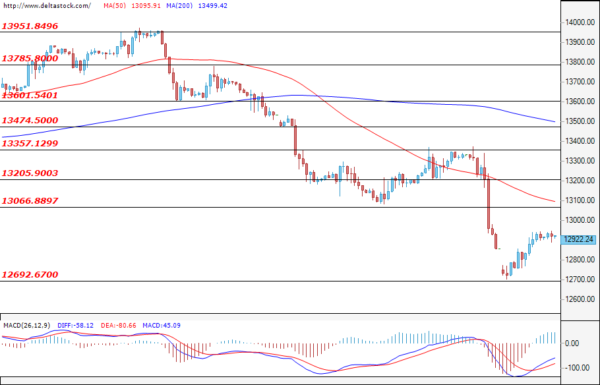

EUGERMANY40

The downward movement of the German index was limited for now and the bears failed to reach the support at 12693. On the other hand, the performance of the bulls so far is equally unconvincing as their target – the resistance at 13066 – is still yet to be reached. If this resistance is not overcome, then it is very likely that the bears will “settle down” for longer than initially expected. The release of the data on the preliminary consumer prices in Germany at 12:00 GMT might rattle the markets and lead to an increase in volatility.

US30

The U.S. blue-chip index is trying to recover from the sell-off in the past week, holding its course above the support level at 31942. On the other hand, the bulls’ target – the resistance at 32473 – is also still left intact. If it remains this way, then we are likely to witness the return of the bears to the market and another attack on the support at 31942.