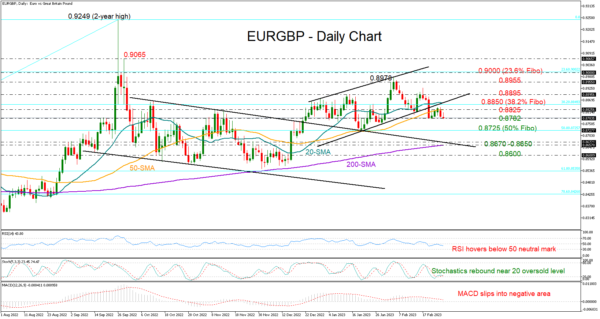

EURGBP pulled below its 50-day simple moving average (SMA) at 0.8820, following encouraging headlines that the UK and the EU have found a new deal to replace the problematic Northern Ireland Protocol, which caused severe disagreements between the two sides.

The downside correction, however, was not strong enough to violate February’s low of 0.8782, providing a ray of hope that the pair may switch back to recovery mode soon. That said, the technical indicators are not generating clear bullish signals yet. Despite the soft upturn in the Stochastic oscillator, the RSI is still hovering slightly below its 50 neutral mark, while the MACD has slipped into the negative region, mirroring persisting selling interest in the market.

Given last week’s bearish channel breakout, the pair might be subject to fresh downside pressures. A decisive close below February’s floor of 0.8782 could intensify selling forces towards January’s trough of 0.8752, where the 50% Fibonacci retracement of the former 0.8201-0.9249 uptrend is located. Another move lower could clear the way towards the constraining descending line from October and the 200-day SMA both seen within the 0.8670-0.8650 zone.

On the upside, the pair keeps facing resistance around its 50-day SMA at 0.8825, while the 0.8850 zone, where the 20-day SMA, the 38.2% Fibonacci level, and the channel’s lower boundary are positioned, may prove a tough obstacle too. Then, a decisive close above the 0.8895 bar will be required for the pair to climb towards February’s resistance zone of 0.8955-0.8978.

In short, EURGBP is still at risk of bearish continuation to 0.8725 despite its resilience above February’s low of 0.8782.