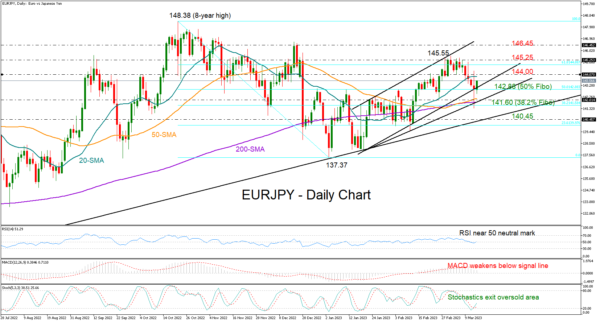

EURJPY minimized its gains and losses around the 142.90 level after an extremely volatile day within the 144.37-141.36 region on Monday.

Traders may pay special attention to the 142.90 area, which has been a key constraining zone since September and currently the lower boundary of a bullish channel. This is also where the 50% Fibonacci retracement of the 148.38-137.37 downleg is placed.

The technical signals are confusing at the moment as the RSI is fluctuating around its 50 neutral mark and the MACD keeps decelerating below its red signal line. That said, the stochastic oscillator is looking to exit the oversold area, and given that it was a better indicator of previous upside reversals, some recovery in the coming sessions cannot be excluded. It’s also worthy to note that the 50-day SMA has avoided a bearish cross with the 200-day SMA, raising hopes that the uptrend from 137.37 may develop higher.

Hence, if the price stays within the channel, the spotlight will turn again to the 144.00 number. A successful penetration higher could trigger a rally towards the 145.20 resistance territory. Should the bulls persist, the recovery could pick up steam towards the channel’s upper boundary at 146.45.

Alternatively, if the 142.90 base cracks, the focus will shift to the 200-day simple moving average (SMA) and the 142.00 number. Should the bears claim that zone, the decline could rump up towards the lower ascending trendline drawn from the 2022 low seen around 140.45. The 23.6% Fibonacci around 140.00 may come next under consideration.

Summing up, EURJPY is looking neutral in the short-term picture. A close below 142.90 could activate fresh selling orders, while a bounce above the 144.00 level is probably required to boost market sentiment.