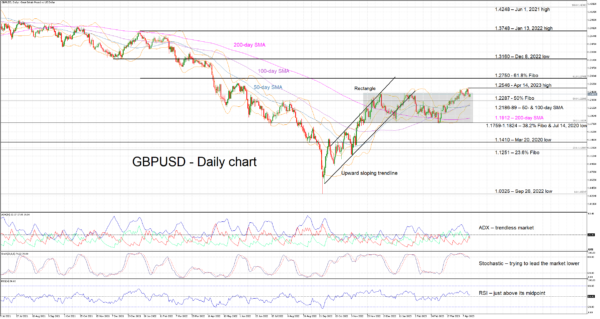

GBPUSD bulls’ upside breakout proved short-lived. They managed to record a higher high of 1.2546 on April 14, 2023, but the pair has returned back inside the rectangle that has formed since Nov 21, 2022. This range-trading activity has resulted in a tightening of the Bollinger Bands and a convergence of the 50- and 100-day simple moving averages (SMAs) respectively. Both are usually signals that a sizeable move is on the cards.

The momentum indicators could provide some clues on the direction of the next move. With the Average Directional Movement Index (ADX) confirming the trendless nature of GBPUSD, the focus turns to the RSI and the stochastic oscillator. The former is just above its midpoint, a sign of a balanced market. However, the stochastic has a more interesting story to tell. It has broken below both its moving average and the overbought territory. An even more aggressive drop could be the signal that GBPUSD bears have been waiting for.

Should this be the case, GBPUSD bears would potentially face support at the 50% Fibonacci retracement of the June 1, 2021 – September 26, 2022 downtrend of 1.2287. Even lower, the 50- and 100-day SMAs await them at the 1.2186-1.2189 range, just ahead of the 200-day SMA heavyweight at 1.1912.

On the other hand, GBPUSD bulls would enjoy staging another upside breakout and retest the April 14, 2023 high of 1.2546. If successful in breaking this level, they would potentially aim for the 61.8% Fibonacci retracement at 1.2750. The path then appears to be clear until the December 8, 2022 low of 1.3160.

To conclude, the failed upside breakout has increased the importance of the current rectangle. Bulls would prefer another retest of the recent highs, but the overall technical picture is not supportive of their intentions.