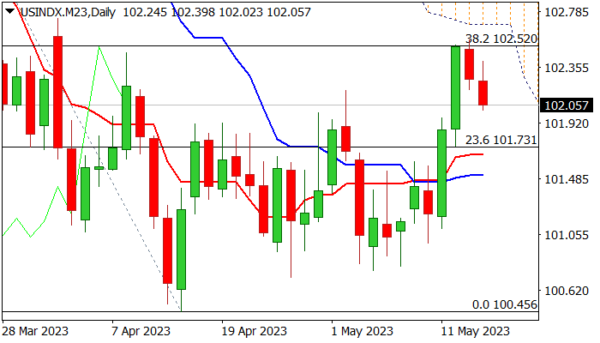

The dollar dipped further on Tuesday morning, extending pullback into second consecutive day after bulls repeatedly failed to break through pivotal Fibo support at 102.52 (38.2% of 105.85/100.45 downleg).

Upside rejection formed a double-top and signals a bull-trap, which adds to the downside pressure.

Conflicting signals on daily chart (strong bullish momentum, overbought stochastic and MA’s in mixed setup) require caution as last week’s strong recovery stalled at a breakpoint zone, also weighed by the nearby base of falling and thickening daily Ichimoku cloud (102.68).

The action failed to violate these barriers and generate fresh bullish signals for further gains, as subsequent pullback shifts near-term risk to the downside, although hopes that bulls may regain ground would be still alive if dips stay above 101.70 (broken Fibo 23.6% / daily Tenkan-sen).

Near-term action remains weighed by uncertainty over debt ceiling crisis, as President Biden was optimistic, while Republicans say that two sides are still far from reaching a deal, ahead of the expected meeting later today.

Res: 102.52; 102.68; 103.15; 103.26.

Sup: 101.91; 101.70; 101.52; 101.09.