EURUSD is holding in a choppy and sideways mode for the fifth consecutive day, as traders look for fresh signals from this week’s key events – Fed minutes and the US June labor data.

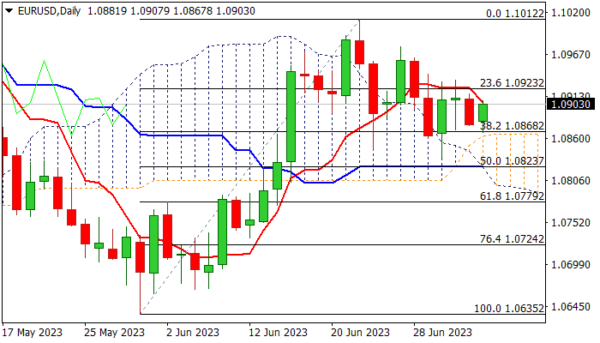

Although the pair is moving within the range, near-term action is expected to remain bullishly aligned while staying above pivotal support at 1.0868 (cracked Fibo 38.2% of 1.0635/1.1012 / top of thickening daily cloud), but without clear direction as long as recent range tops at 1.0930 zone cap.

Daily studies lack direction signal as momentum is negative, MA’s are in mixed setup and RSI is turning up.

Markets await release of minutes of Fed’s last policy meeting (due later today) for more clues about the central bank’s monetary policy path and key event this week – US non-farm payrolls (June 225K f/c vs May 339K), which are expected to spark stronger volatility in the market.

Expect initial direction signals on breach of either pivotal level (1.0868 / 1.0930) which will look for verification on extension through next triggers (1.0823 at the downside or 1.0976 at the upside).

Res: 1.0930; 1.0976; 1.1000; 1.1012.

Sup: 1.0868; 1.0835; 1.0823; 1.0779.