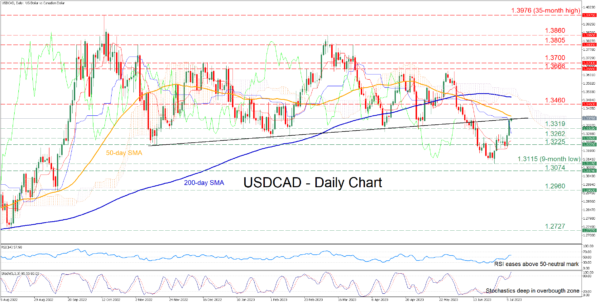

USDCAD had been in a steady downtrend since late May, generating a clear structure of lower lows. However, the pair found its feet at the nine-month bottom of 1.3115 and retraced back higher, with the price challenging the ascending trendline that connects the pair’s higher lows from November 2022 since early May.

The momentum indicators currently suggest that near-term risks are tilted to the upside. Specifically, the RSI is flatlining comfortably above its 50-neutral mark, while the stochastics are positively charged within the 80-overbought zone.

Should the price extend its advance above the trendline and the 50-day simple moving average (SMA), initial resistance could be found at 1.3460. Jumping above the latter, the pair could face the April peak of 1.3666. Even higher, the spotlight could turn to the 1.3700 psychological mark, which held strong in December 2022.

Alternatively, if the recovery falters and the pair dives lower again, the May support of 1.3319 may curb any downside attempts. A break below that zone could trigger a retreat towards the February low of 1.3262. Failing to halt there, the price might then revisit the August 2022 bottom of 1.3225.

In brief, USDCAD has been in a recovery phase after its steep decline came to a halt at a fresh 2023 low. For that rebound to resume, the price needs to reclaim its 50-day SMA.