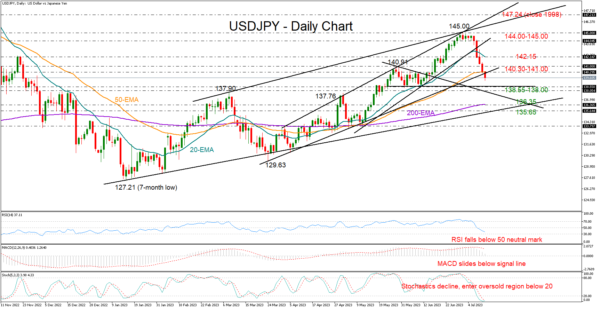

USDJPY has been sold aggressively since the NFP release last Friday, falling by almost 2.0% to a one-month low of 139.30.

The bears snapped the latest bullish wave from mid-June, which peaked at 145.00, currently aiming for a close below the 50-day exponential moving average (EMA) and the support trendline from the March low at 140.30.

Given the negative trajectory in the momentum indicators, the freefall in the price is expected to gain another leg to enter the 138.55-138.00 constraining zone, where the price stabilized back in June. It’s worthy to note that the 20-period EMA in the weekly chart is flattening within the same boundaries. Hence, a decisive close lower, and more importantly below 137.50, could renew selling pressures, shifting the spotlight to the 200-day EMA at 136.35. A drop below the 2023 ascending trendline at 135.65 would then signal a trend deterioration in the long-term picture.

An upside reversal, however, could be underway as the stochastic oscillator seems to be looking for a pivot within the oversold region below 20. Should the bulls take control immediately, pushing the pair back above the 140.30-141.00 area, they may initially pause around the 20-day EMA at 142.15. Even higher, traders would like to see an advance above the 144.00-145.00 zone and beyond the two ascending lines in order to raise their buying orders.

In brief, USDJPY could remain downbeat in the coming sessions, with traders looking for support within the 138.55-138.00 region. A bounce above 140.30-141.00 could reduce downside risks.