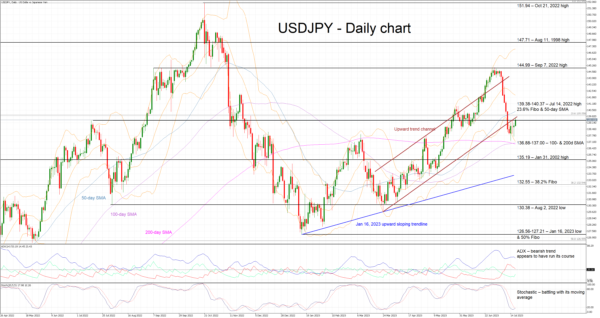

USDJPY is trading higher again today following a significant correction that muted the growing intervention talk. The pair is preparing to enter a very busy area as the bulls are trying to regain market control and take advantage of the continued simple moving averages (SMAs) convergence for their own benefit.

The momentum indicators appear to be mostly on the bulls’ side at this stage. The Average Directional Movement Index (ADX) is edging lower today, confirming a much weakened bearish trend in the market but still remaining at elevated levels compared to its recent history. Crucially, the stochastic oscillator is attempting to break above both its oversold territory and moving average. If successful, a strong bullish signal will be sent.

Having said that, the bulls are ready for another upleg. They would have to clear the resistance set by the lower boundary of the recent upward trend channel and the busy 139.38-140.37 area. This is populated by the July 14, 2022 high, the 23.6% Fibonacci retracement level of the March 9, 2022 – October 21, 2022 uptrend and the 50-day SMA. The path then looks clear until the September 7, 2022 high at 144.99.

On the flip side, the bears are trying to avoid a return to the recent USDJPY highs. They appear willing to defend the 139.37-140.37 range and, if successful, stage a move towards the 136.88-137.00 area that is defined by the 100- and 200-day SMAs. Even lower, the January 31, 2002 high at 135.19 is unlikely to trouble them.

To sum up, the bulls are trying to reassert their dominance, but the stochastic oscillator’s next move will play a key role in the next USDJPY leg.