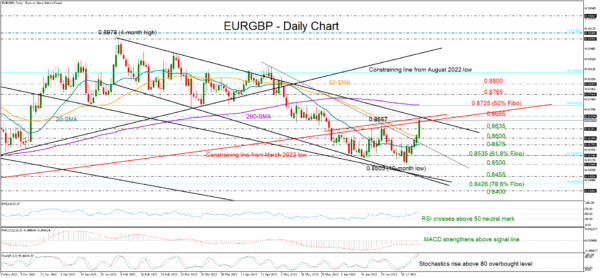

EURGBP experienced a sharp increase from softer-than-expected UK CPI inflation numbers, with the price rising as high as 0.8673 – the fastest daily increase since March 21.

Today’s quick pick up sent the RSI back above its 50 neutral mark and the MACD further above its red signal line and closer to zero. Still, a bullish bias cannot be guaranteed as the stochastic oscillator is already comfortably above its 80 overbought level. Moreover, the price is trading around the the upper boundary of the bearish channel at 0.8483, increasing the risk of a downside reversal.

Even if the pair was about to exit the channel on the upside at 0.8685 and close above the ascending line from March 2022, the 200-day simple moving average (SMA) could still reject any further improvement along with the 50% Fibonacci retracement of the 0.8201-0.9249 upleg at 0.8725. If not, the ascent could stretch till the swing high of 0.8765 and then aim for the 0.8800 psychological mark.

Should selling pressures resurface, pulling the pair below the previous resistance zone of 0.8635, the focus will immediately turn to the 50-day SMA at 0.8608. The 20-day SMA could next appear on the radar at 0.8577, while lower, the 61.8% Fibonacci level of 0.8535 could postpone any declines towards July’s trough of 0.8500. If the 2023 downtrend resumes below the latter point, the next stop could be at the channel’s bottom line at 0.8455.

Summing up, EURGBP has not entered a bullish area yet despite picking up momentum over the past couple of sessions. The pair will need a sustainable upleg above the 200-day SMA to bring new buyers into the market.