- USDCAD jumps above 1.3700 ahead of BoC rate decision

- Will the pair breach the neutral triangle pattern too?

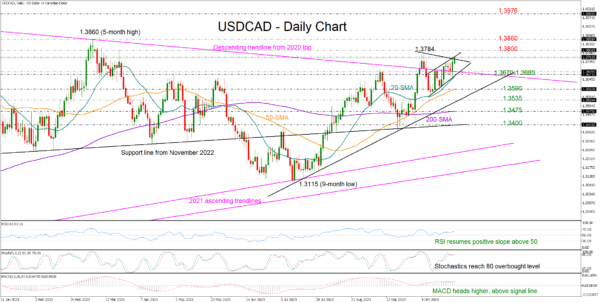

USDCAD held its footing above the resistance-turned-support trendline drawn from the 2020 peak and bounced back into the 1.3700 area on Tuesday.

The latest bullish action shifted the attention back to the 1.3800-1.3860 region ahead of the Bank of Canada’s policy meeting, with the technical indicators promoting further progress in the market. The RSI has resumed its positive slope above 50 and the MACD is heading higher above its red signal line.

Conversely, the stochastic oscillator is staying close to its 80 overbought level, implying that the bulls are lacking the strength to push upwards. Also, the price itself has yet to close above the resistance line of a symmetrical triangle at 1.3750, making a pullback likely.

Should the pair accelerate above 1.3860, the next destination could be the 2022 top of 1.3976.

On the downside, the 1.3670-1.3685 zone, which encapsulates the 2020 constraining line and the 20-day simple moving average (SMA) could come first into view. A close below this range could confirm more losses towards the 50-day SMA, while a sharper decline could challenge the short-term ascending trendline from July at 1.3535 and the 200-day SMA.

In summary, USDCAD has the potential for more upside, but unless it successfully violates the neutral triangle structure, the bulls could face some more delays.