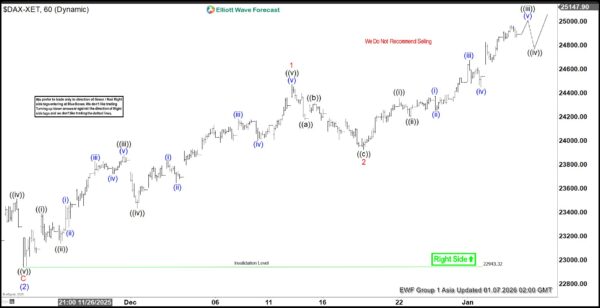

The DAX continues to advance to new highs, confirming that the right side of the market remains bullish. The decline from the November 21, 2025 low at 22,943 marked the end of wave (2). From that level, the Index began a rally in wave (3), unfolding with clear internal subdivisions consistent with an impulsive Elliott Wave structure. Wave ((i)) concluded at 23,392.2, followed by a pullback in wave ((ii)) that ended at 23,139.27. The Index then extended higher in wave ((iii)) toward 23,883.98. A corrective dip in wave ((iv)) found support at 23,433.48. The final leg, wave ((v)), carried prices to 24,474.62, completing wave 1 of a higher degree sequence.

After this advance, the Index corrected in wave 2, which unfolded as a zigzag. Wave ((a)) ended at 24,173.28, wave ((b)) at 24,318.3, and wave ((c)) at 23,923.97. This completed wave 2 and set the stage for renewed strength. The market has since resumed higher in wave 3 of (3). The potential upside target is projected at the 100% to 161.8% Fibonacci extension of wave 1, spanning 25,450 to 26,403. In the near term, as long as the pivot at 22,943.3 remains intact, pullbacks should find support within the typical three, seven, or eleven swing corrective structures, paving the way for further gains.

DAX 60 minute chart from 01.07.2026 update

DAX Elliott Wave video:

You are currently viewing a placeholder content from Default. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.