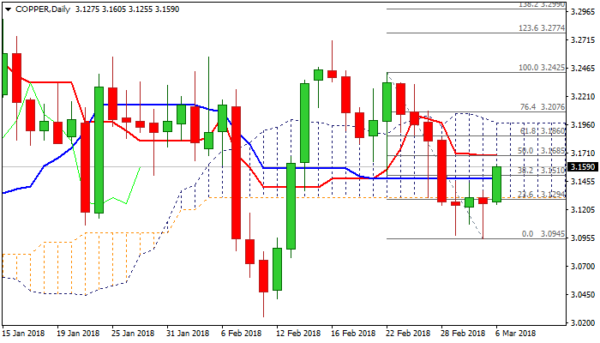

Copper advanced on Tuesday and penetrated thick daily cloud, after three-day congestion remained capped by cloud base.

Fresh advance is generating reversal signal after repeated strong downside rejections left higher base at $3.0950 zone and fresh rally dented pivotal barrier at $3.1510 (Fibo 38.2% of $3.2425/$3.0945 descend).

Existing fears of global trade war intensified again after President Trump said he will stick to his guns despite growing pressure to drop the tariff plan, boosting copper price on Tuesday.

Fresh bullish tone is developing on lower timeframes, but studies on daily chart remain in firm bearish mode.

Bulls need firm break into daily cloud as minimum requirement, with break above Fibo barrier at $3.1510 and nearby 100SMA at $3.1545, required for firmer bullish signal.

However, plethora of barriers that lies above, weighs on near-term action. Stronger acceleration through $3.1623/$3.1751 zone (20/10/30SMA’s) is required to further inflate bulls and signal further recovery towards next pivots at $3.1865 (Fibo 61.8% of $3.2425/$3.0945) at $3.1975 (daily cloud top).

Res: 3.1623, 3.1751, 3.1865, 3.1975

Sup: 3.1510, 3.1312, 1.1255, 3.1075