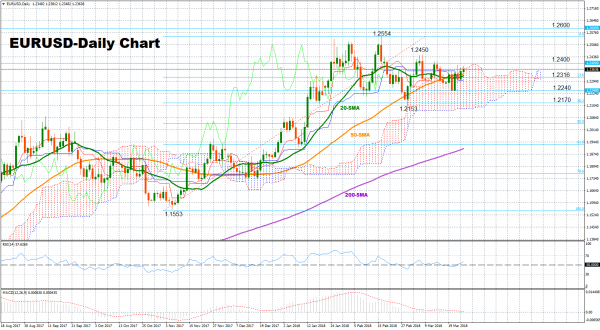

EURUSD closed higher in Friday’s trading but maintained in a range between 1.2150-1.2450 started at the end of February, with technical indicators suggesting that the sideways pattern might continue for a while.

Looking at momentum indicators, the RSI is pointing to the upside, giving some positive signals for the short-term, though, the index has not deviated much above its neutral threshold of 50. Therefore, we expect the pair to improve moderately in the short-term, remaining overall in a range. MACD barely holds in positive territory and is still capped by its red signal line, painting a neutral picture as well.

Should the pair make a step higher, the area between 1.2400-1.2450, which includes February’s highs, could offer nearby resistance before the focus shifts to the three-year peak of 1.2554. A close above this top could see prices rallying towards the 1.26 handle, while a more decisive upside move could open the door to the 1.2700 psychological level as well.

To the downside, if the market weakens, support could come around the area between 1.2336-1.2316 where the 23.6% Fibonacci of the upleg from 1.1553 to 1.2554, and the 50- and the 20-day simple moving average lines are currently located. A leg below this mark could target 1.2240, a frequently congested area since the beginning of the year, while steeper decreases could also revisit the 38.2% Fibonacci of 1.2170. However, only a break below the March low of 1.2153 could trigger bearish extensions, resuming the downtrend from 1.2554.

In the medium-term, the market looks bullish, given that the market maintains its uptrend recorded over the last three months and the bullish cross between the 50-day and the 200-day SMA remains intact. However, the bullish signals could be stronger if prices manage to increase their distance from the 50-day SMA.