Yen opens the year with a strong note and rises to a six-month high against Dollar. The strength is also broad based. The move extends the rally since BoJ’s decision to raise the cap on 10-year JGB yield last month. There is some expectation of further tweak of the yield curve control in the early part of this year, or even an exit of the decade long ultra-loose monetary policy.

USD/JPY’s break of 130.55 support confirms resumption of whole down trend from 151.93. Near term outlook will stay bearish as long as 134.49 resistance holds in case of recovery. Sustained trading below 55 week EMA (now at 131.65) would pave the way to 61.8% retracement of 102.58 to 151.93 at 121.43 in the medium term.

CAD/JPY’s break of 95.83 also indicate resumption of whole down trend from 110.87. Near term outlook will remain bearish as long as 99.28 resistance holds, in case of recovery. Next medium term target is 61.8% retracement of 73.80 to 110.87 at 87.96.

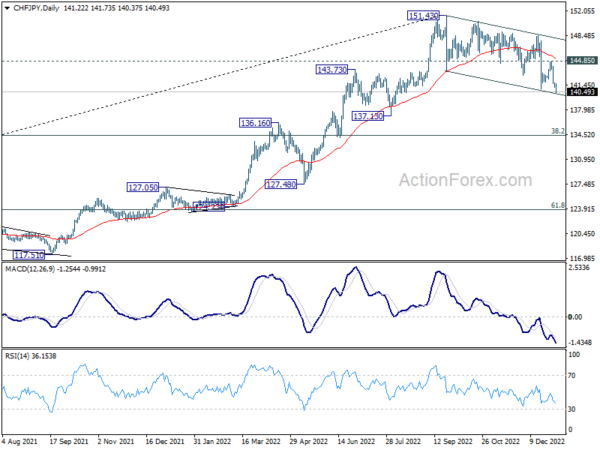

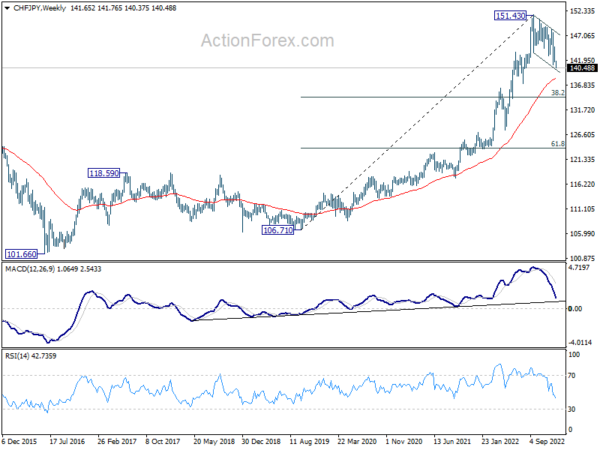

Even the relatively resilient CHF/JPY is resuming the fall from 151.43. Rejection below 55 day EMA is a bearish sign. Fall from 151.43 would target 55 week EMA (now at 138.19), or even further to 38.2% retracement to 38.2% retracement of 106.71 to 151.43 at 134.34.