Gold dipped below 2000 as near-term pullback extended into Asian session, with many markets still on holiday. Shift appears to be driven by growing market conviction that Fed will implement another 25bps hike in May, as fed fund futures now indicate a 66% probability. This sentiment follows last week’s robust US non-farm payroll report. However, expectations could still change after release of March CPI data and FOMC minutes on Wednesday.

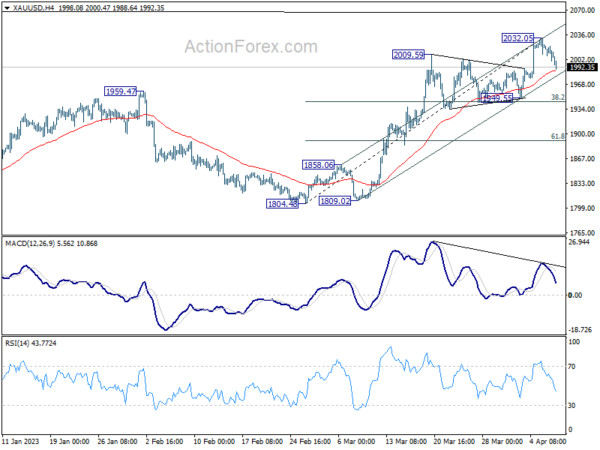

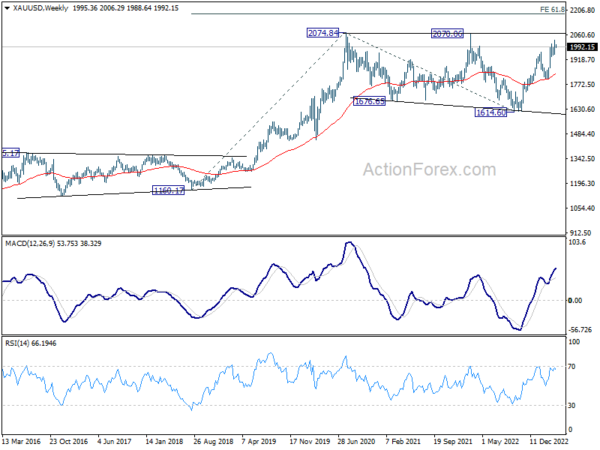

Technically, a short-term top for Gold may have formed at 2032.05, evidenced by a bearish divergence in 4-hour MACD. Rally from 1084.48 might have completed a five-wave sequence and stalled just ahead of key resistance zone between 2070.06 and 2074.84 record high.

Considering this, a deeper pullback is now anticipated. Crucial near-term support level can be found at 38.2% retracement of 1804.48 to 2032.05 at 1945.11 which is in proximity to 1949.55 support level. As long as this support zone holds, current price action from 2032.05 should be regarded as a brief corrective phase, and a rally to new record highs is expected sooner rather than later.

However, sustained break of 1945.11/1949.55 support zone could signal a deeper fall in underway, possibly extending the long-term consolidation pattern from 2074.84 with another downward leg. In this scenario, gold prices could decline to 61.8% retracement of 1804.48 to 2032.05 at 1894.41 or even further towards 1084.48.