SNB raises policy rate by 25bps to 1.75%, for “countering inflationary pressure, which has increased again over the medium term”. The central bank also leaves the door open for more tightening, as “it cannot be ruled out that additional rises in the SNB policy rate will be necessary”. SNB also maintains the willingness to intervene in the currency markets, with focus on “selling foreign currency”.

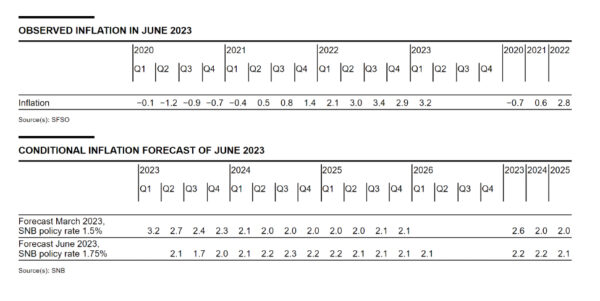

In the new conditional forecast, 2023 inflation projection is lowered from 2.6% to 2.2%, down in from Q2 through Q4, with trough at 1.7% in Q3. However, 2024 and 2025 inflation projections are raised from 2.0% (both) to 2.2% and 2.1% respectively. Inflation is estimated to stay above 2% target from the tart of 2024 through Q1 2026, with a peak at 2.3% in Q3 2023.

Regarding the economy, SNB expects “modest growth” for the rest of the year. Overall GDP is to growth by 1.0% in 2023 and unemployment rise will “probably rise slightly”. “Subdued demand from abroad, the loss of purchasing power due to inflation, and more restrictive financial conditions are having a dampening effect.”