The latest OECD Interim Economic Outlook has revealed revised global growth forecasts, with an incremental uptick for 2023 followed by a slight dip in 2024. The updated predictions reflect a blend of uplifted expectations for some economies and dampened hopes for others, amidst a backdrop of inflation concerns and the repercussions of a more sluggish recovery in China.

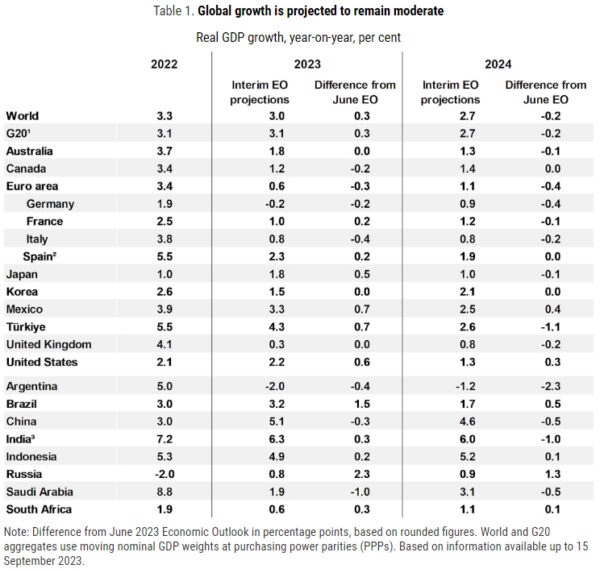

For 2023, the global economic growth forecast now stands at 3.0%, marking a 0.3% increase from previous predictions. Conversely, projections for 2024 have seen a decrease of -0.2%, bringing the anticipated growth down to 2.7%.

Dissecting the outlook on a regional basis unveils a mixed bag of prospects:

- US: A positive revision with growth estimates standing at 2.2% for 2023, up by 0.6%, and a 1.3% prediction for 2024, reflecting a 0.3% increase.

- Eurozone: Here the expectations have been trimmed down with 2023 forecasts reduced by -0.3% to a mere 0.5%, and a 2024 estimate of 1.1%, down by -0.4%.

- Japan: The outlook for 2023 appears brighter with a 0.5% increase to 1.8%, although the 2024 forecast has been slightly reduced by -0.1%, standing at 1.0%.

- China: Forecasts have been negatively revised to 4.1% in 2023, a drop of -0.3%, and 4.6% in 2024, reflecting a decrease of -0.5%.

The OECD outlook points out considerable downside risks, emphasizing potential persistency in inflation accompanied by potential disruptions in the food and energy markets. Slowdown in China’s economy stands as a prominent concern, with ripple effects expected to diminish growth in global trading partners and possibly undercut business confidence universally.

Projections for headline inflation in G20 nations indicate a gradual decrease through 2023, moving from 7.8% in 2022 to 6.0% in 2023, and further dwindling to 4.8% in 2024. However, core inflation, primarily fueled by the services sector and relatively taut labour markets, is predicted to linger, necessitating a sustained restrictive posture in monetary policy across several countries.

As economies globally grapple with these changing dynamics, the emphasis remains on steering a cautious course, with a keen eye on inflation patterns as a decisive factor in shaping future policy directions. The evolving economic narrative dictates a necessity for many countries to maintain interest rates close to their present markers, extending well into 2024.