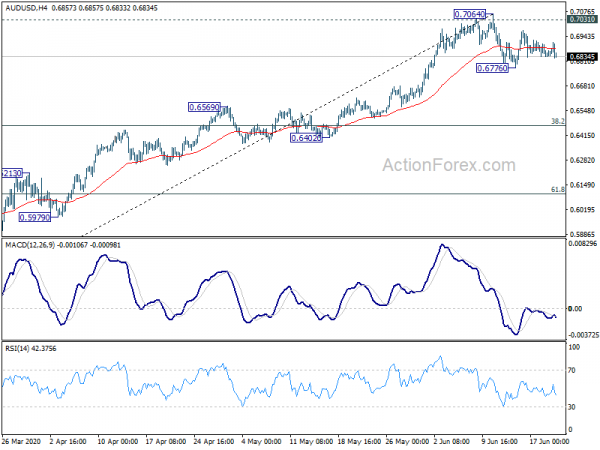

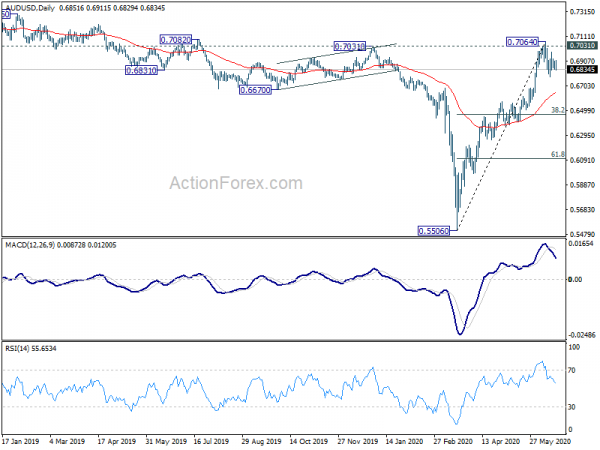

AUD/USD edged lower to 0.6776 last week but turned sideway since then. Initial bias remains neutral this week first. As a short term top was formed, further decline will remain in favor as long as 0.7064 holds. On the downside, break of 0.6776 will target 38.2% retracement of 0.5506 to 0.7064 at 0.6469.

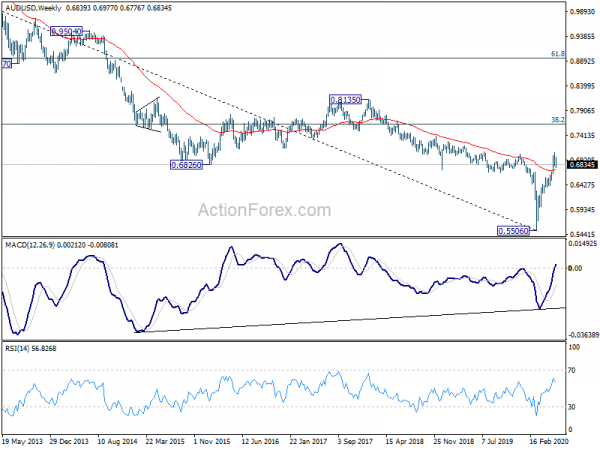

In the bigger picture, rebound from 0.5506 medium term bottom could be correcting whole long term down trend form 1.1079 (2011 high). Further rally would be seen to 55 month EMA (now at 0.7340). This will remain the preferred case as long as it stays above 55 week EMA (now at 0.6721). Sustained trading below 55 week EMA will turn focus back to 0.5506 low instead.

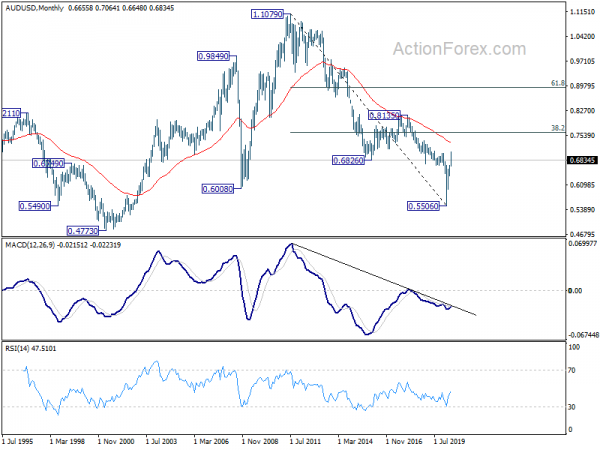

In the longer term picture, there is no change in the view that down trend from 1.1079 (2011 high) is still in progress. Such down trend could extend through 0.5506 low after completing the corrective rise from there. However, sustained break of 55 month EMA (now at 0.7340) will raise the chance of long term reversal and turn focus back to 0.8135 key resistance.