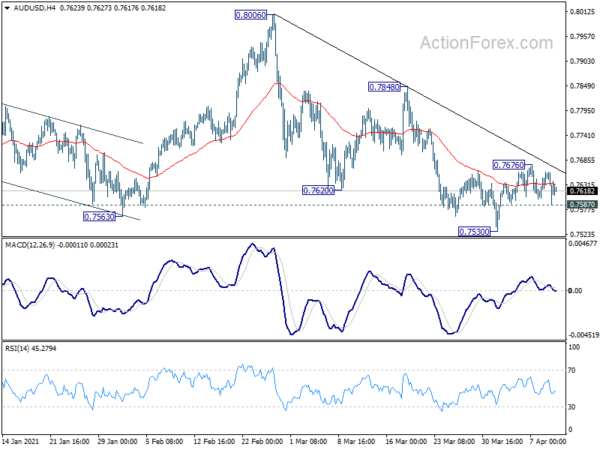

AUD/USD edged higher to 0.7676 last week but struggled to break through 55 day EMA and turned sideway. Initial bias remains neutral this week first. Rebound form 0.7530 is in favor to continue as long as 0.7587 minor support holds. Break of 0.767 will target 0.7848 resistance. Firm break there should confirm completion of the corrective fall from 0.8006. However, break of 0.7587 will likely resume the correction from 0.8006 through 0.7530.

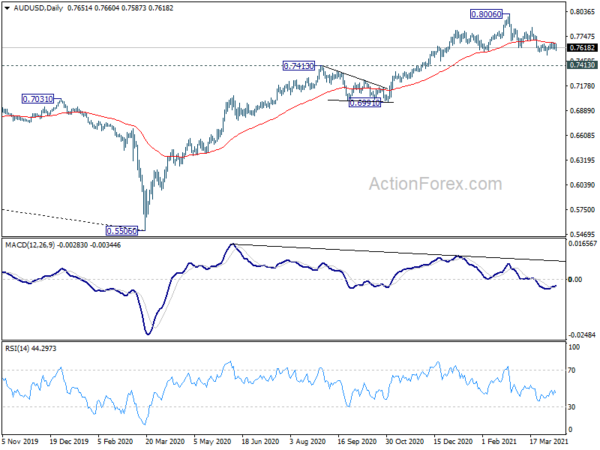

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

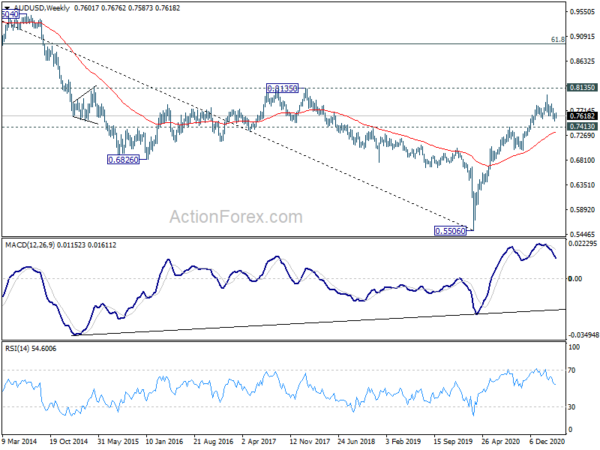

In the longer term picture, 0.5506 is a long term bottom, on bullish convergence condition in monthly MACD. Focus is now back on 0.8135 structural resistance. Decisive break there will raise the chance that rise from 0.5506 is an impulsive up trend. Next target should be 61.8% retracement at 0.8950 of 1.1079 to 0.5506 and above. Though, rejection by 0.8135 will keep the case of medium to long term sideway consolidation open.