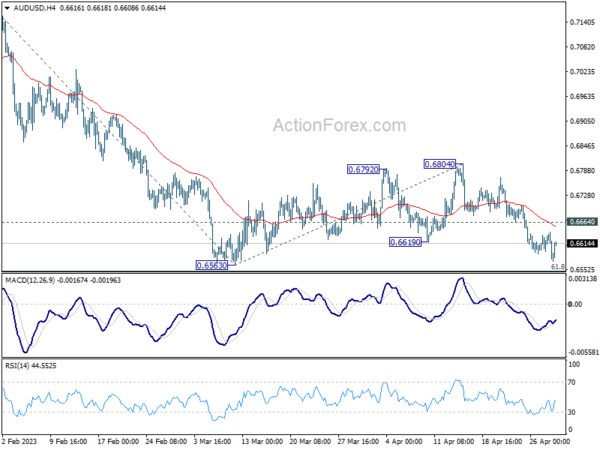

AUD/USD’s decline and break of 0.6619 last week argues that corrective pattern from 0.6563 has completed at 0.6804. Further decline is in favor this week as long as 0.6664 resistance holds. Firm break of 0.6563 will resume larger decline from 0.7156, and bring deeper decline through 0.6546 fibonacci level to 61.8% projection of 0.7156 to 0.6563 from 0.6804 at 0.6438 next. On the upside, break 0.6664 minor resistance will turn bias to the upside to extend the consolidation pattern with another rising leg.

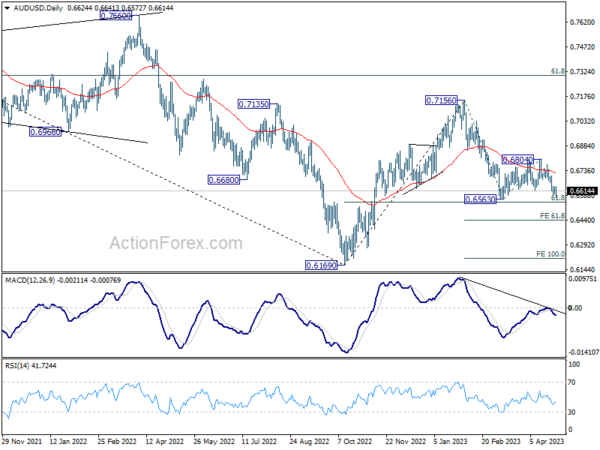

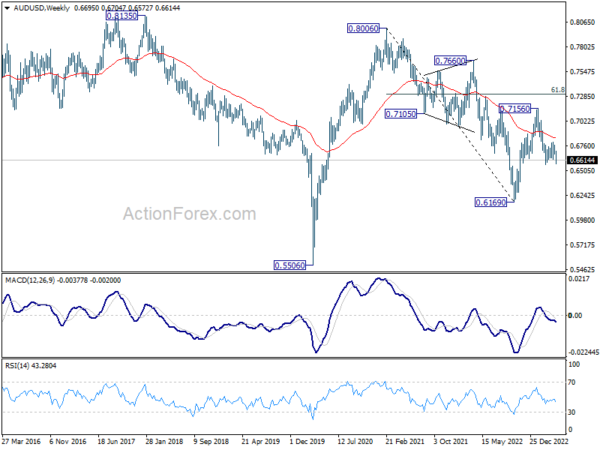

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

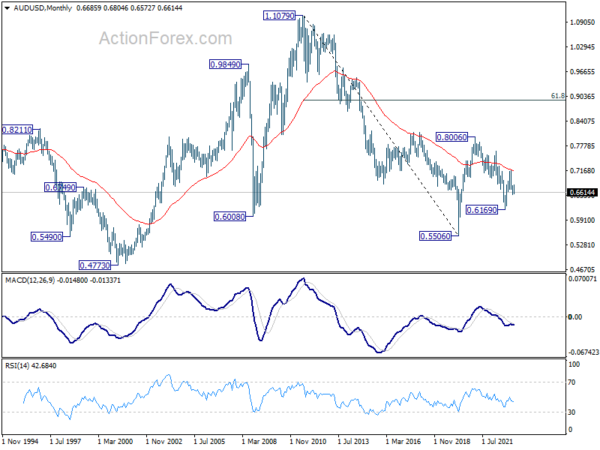

In the long term picture, initial rejection by 55 M EMA (now at 0.7145) retains long term bearishness. That is, down trend from 1.1079 (2011 high) could still resume through 0.5506 (2020 low) on resumption.