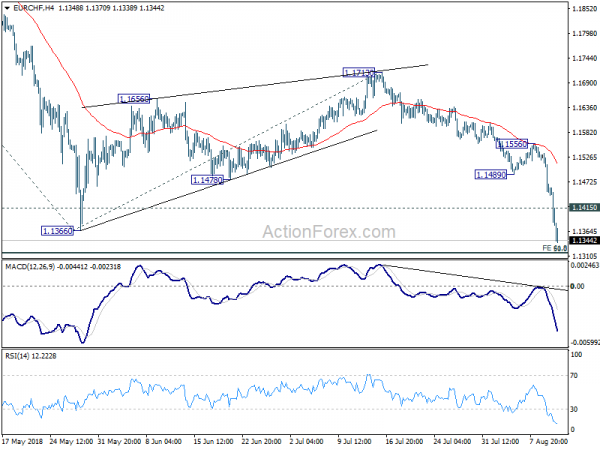

EUR/CHF dropped sharply to as low as 1.1336 last week. Break of 1.1366 confirmed resumption of whole decline from 1.2004. Initial bias stays on the downside this week for 61.8% projection of 1.2004 to 1.1366 from 1.1713 at 1.1319. Decisive break there will target key support zone between 1.1154/98. On the upside, above 1.1415 minor resistance will turn intraday bias neutral and bring consolidation. But recover should be limited below 1.1489 support turned resistance to bring another fall.

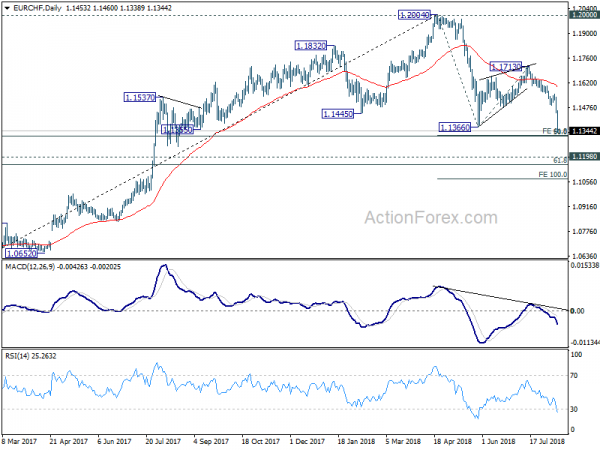

In the bigger picture, for now, the price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1173) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend.