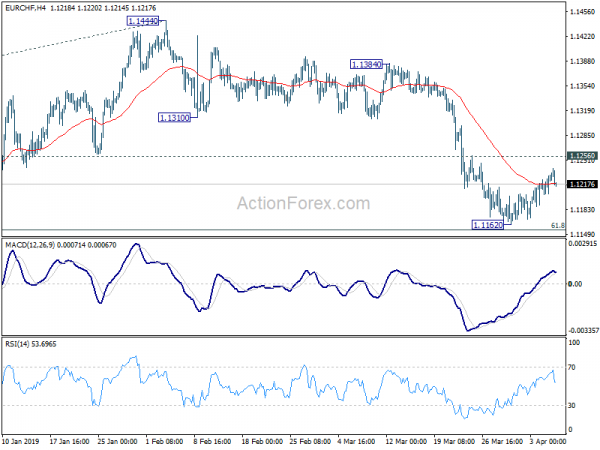

EUR/CHF’s corrective recovery from 1.1162 extended higher last week. Initial bias stays neutral first and more consolidative could be seen. But after all, as long as 1.1256 minor resistance holds, near term outlook remains bearish and further decline is expected. On the downside, decisive break of 1.1154 key fibonacci level will confirm resumption of whole downtrend from 1.2004. That should then pave the way to 61.8% projection of 1.2004 to 1.1173 from 1.1444 at 1.0930. However, break of 1.1256 will indicate short term bottoming and turn bias back to the upside for 1.1310 support turned resistance first.

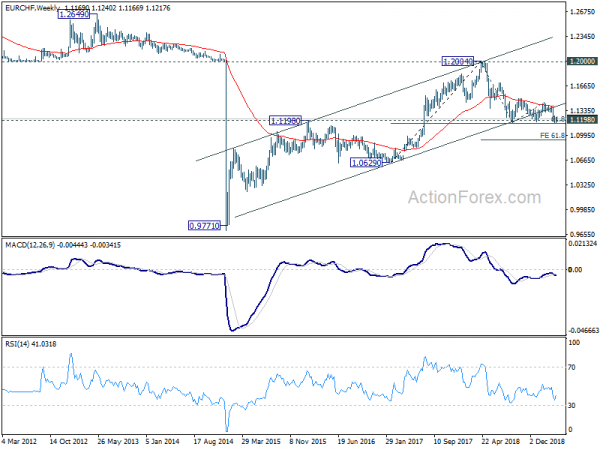

In the bigger picture, multiple rejection by 55 week EMA indicates medium term bearishness. Focus remains on 1.1154/98 support zone (2016 high and 61.8% retracement of 1.0629 to 1.2004 at 1.1154). Decisive break there will confirm resumption of whole down trend from 1.2004 and long term bearish reversal. EUR/CHF should then target 1.0629 support and below. This will now remain the favored case as long as 1.1444 resistance holds.

In the long term picture, the current development argues that long term up trend has completed at 1.2004 after rejection of 1.2 key resistance. Sustained break of 1.1198 support will confirm this bearish case and target 1.0629 and below.