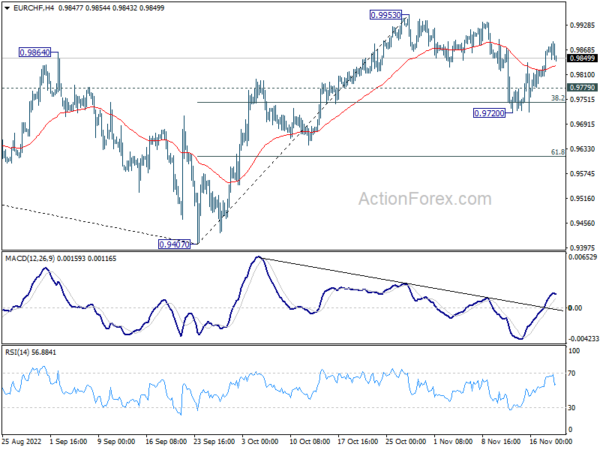

EUR/CHF’s recovery last week suggests that pull back from 0.9953 has completed at 0.9720, after drawing support from 38.2% retracement of 0.9407 to 0.9953 0.9744. Initial bias is mildly on the upside this week for retesting 0.9953. Firm break there will resume the rally from 0.9407 to 1.0072 fibonacci level. However, break of 0.9779 will likely resume the fall from 0.9953 through 0.9720.

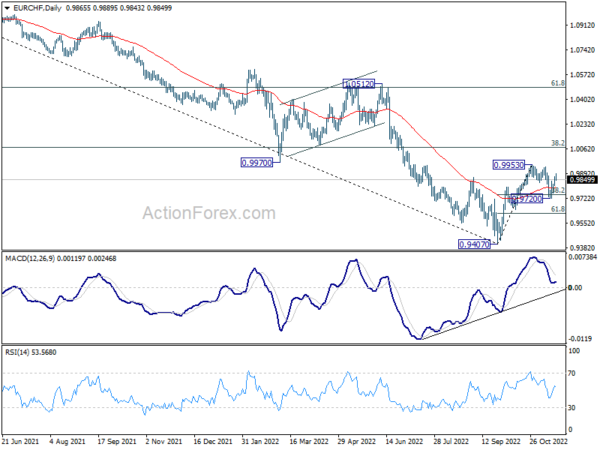

In the bigger picture, rejection by 0.9970 support turned resistance retains medium term bearishness. That is, while 0.9407 is a medium term bottom, price actions from there would develope into a corrective pattern rather than a reversal. Down trend resumption through 0.9407 is mildly favored at a later stage. This will remain the favored case now, as long 38.2% retracement of 1.1149 to 0.9407 at 1.0072 holds.

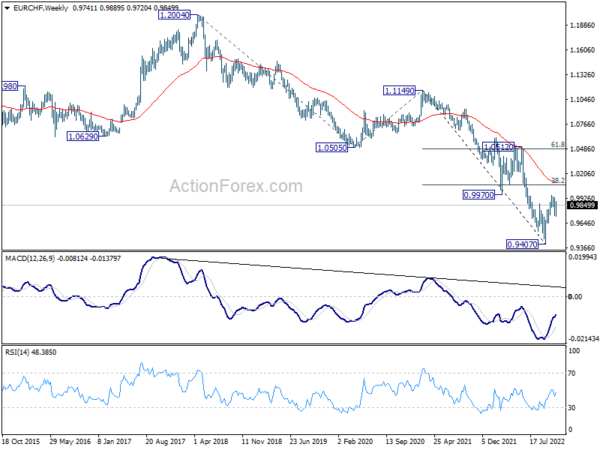

In the long term picture, capped well below 55 month EMA, EUR/CHF is seen as extending the multi-decade down trend. There is no prospect of a bullish reversal until firm break of 1.0505 support turned resistance (2020 low). In case of resumption, next target is 138.2% projection of 1.2004 to 1.0505 to 1.1149 at 0.9033.