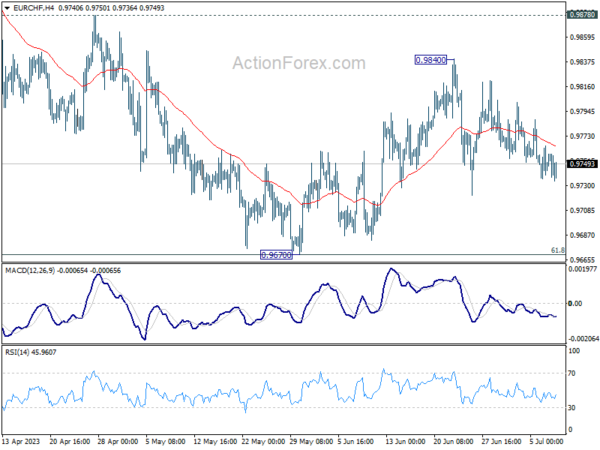

EUR/CHF continued to gyrate in established range last and outlook is unchanged. Initial bias stays neutral this week first. On the upside break of 0.9840 will resume the rebound from 0.9670. That will also revive the case that whole corrective decline from 1.0095 has completed at 0.9670. Further rally should be seen to 0.9878 resistance next. However, sustained trading below 0.9670 will resume the whole fall from 1.0095.

In the bigger picture, medium term outlook is staying bearish as the pair is capped below falling 55 W EMA (now at 0.9913). Down trend form 1.2004 (2018 high) is in favor to extend through 0.9407 at a later stage. Nevertheless, decisive break of 38.2% retracement of 1.1149 to 0.9407 will raise the chance of bullish trend reversal.

In the long term picture, it’s still way too early too call for bullish trend reversal with upside capped well below 55 M EMA (now at 1.0459) and 1.0505 support turned resistance (2020 low). The multi-decade down trend could still continue.