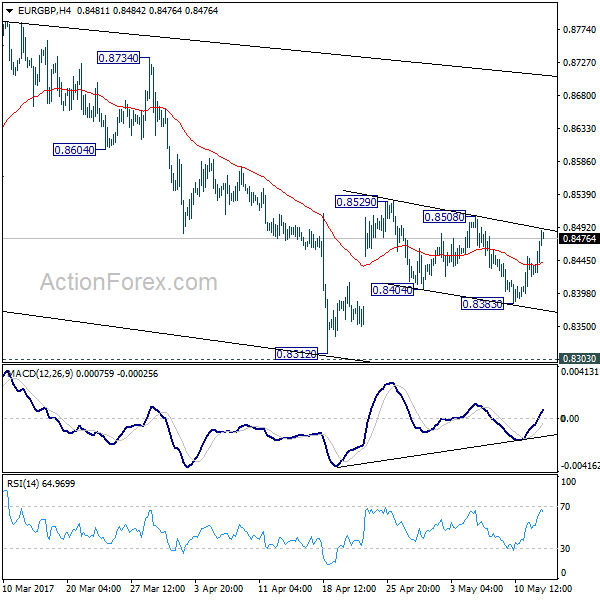

EUR/GBP dipped to 0.8383 last week but quickly recovered. The corrective structure of fall from 0.8529 to 0.8383 suggests that rebound from 0.8312 is still in progress. Break of 0.8508 resistance should confirm and bring stronger rise.

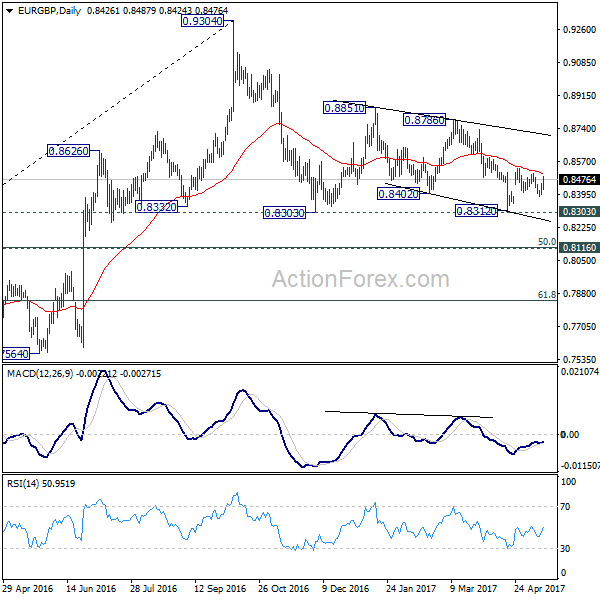

Initial bias in EUR/GBP remains neutral this week first. On the upside, break of 0.8508 will extend the rebound from 0.8312 to 0.8786 resistance next. Further break there will target 0.9304 high. On the downside, below 0.8383 will turn bias to the downside for 0.8303/8312 support zone instead. Overall, EUR/GBP is staying in the corrective pattern from 0.9304 which will extend for a while.

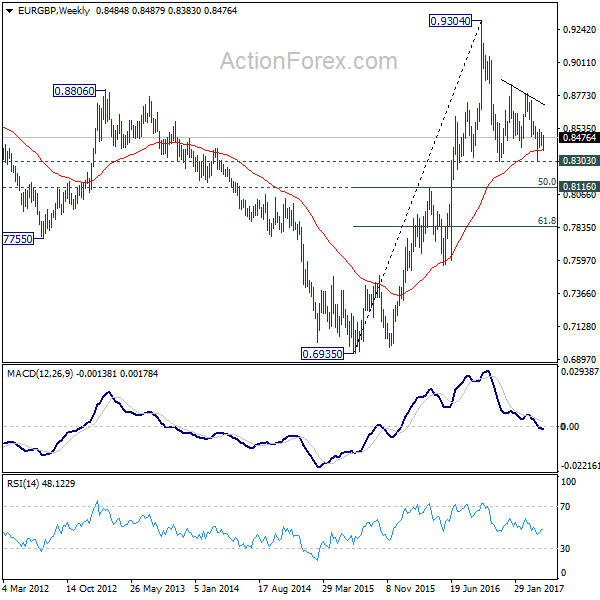

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. In case of deeper fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Rise from 0.6935 (2015 low) will resume at a later stage to 0.9799 (2008 high). However, sustained break of 0.8116 could bring deeper decline to next key support level at 0.7564 before the correction completes.

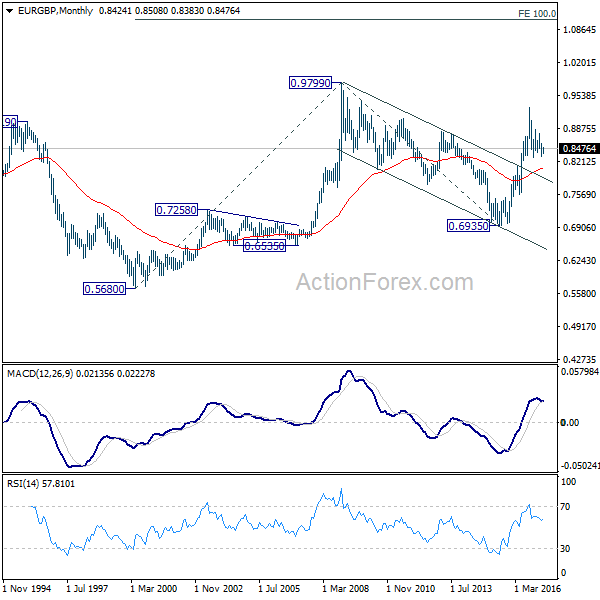

In the long term picture, firstly, price action from 0.9799 (2008 high) is seen as a long term corrective pattern and should have completed at 0.6935 (2015 low). Secondly, rise from 0.6935 is likely resuming up trend from 0.5680 (2000 low). Thirdly, this is supported by the impulsive structure of the rise from 0.6935 to 0.9304. Hence, after the correction from 0.9304 completes, we’d expect another medium term up trend to target 0.9799 high and above.