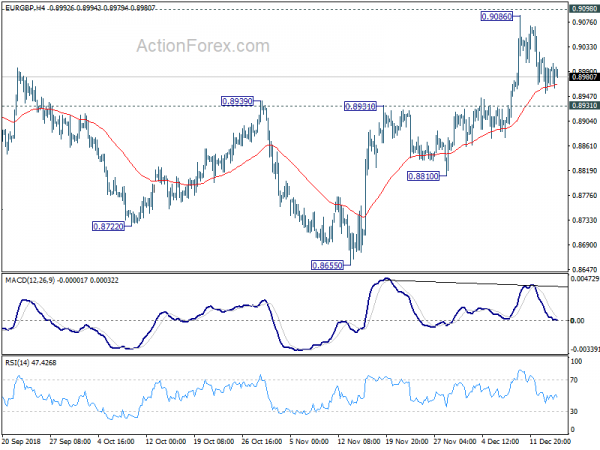

EUR/GBP surged to as high as 0.9086 last week but failed to take out 0.9098 resistance, and turned into consolidation. Initial bias remains neutral this week first. As long as 0.8931 resistance turned support holds, further rise is expected. Decisive break of 0.9098 resistance will extend the rally from 0.8655 and target 0.9304 key resistance next. However, considering bearish divergence condition in 4 hour MACD, firm break of 0.8931 will indicate near term reversal and target 0.8810 support and below.

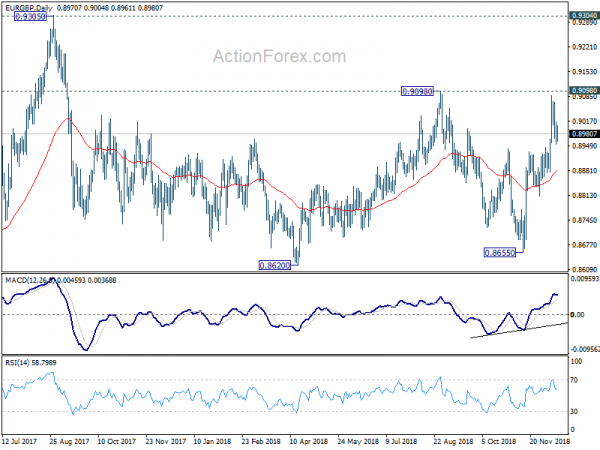

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). It should be in medium term rising leg for 0.9304. Meanwhile, in case of another fall, down side should be contained by 0.8620/55 support zone to bring rebound.

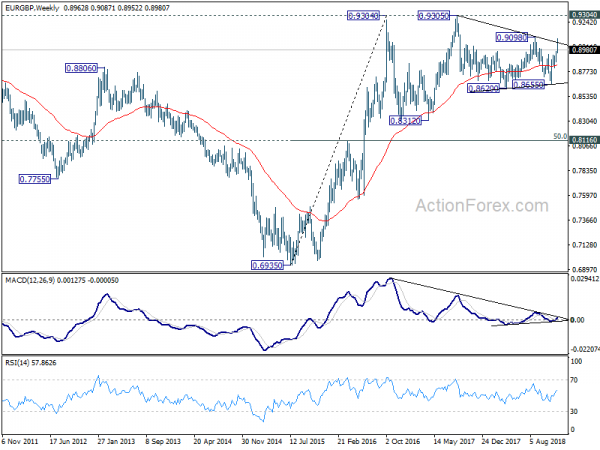

In the long term picture, we’re holding on to the view that rise from 0.6935 (2015 low) is resuming the up trend from 0.5680 (2000 low). Hence, after the consolidation from 0.9304 completes, we’d expect another medium term up trend through 0.9799 to 100% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.