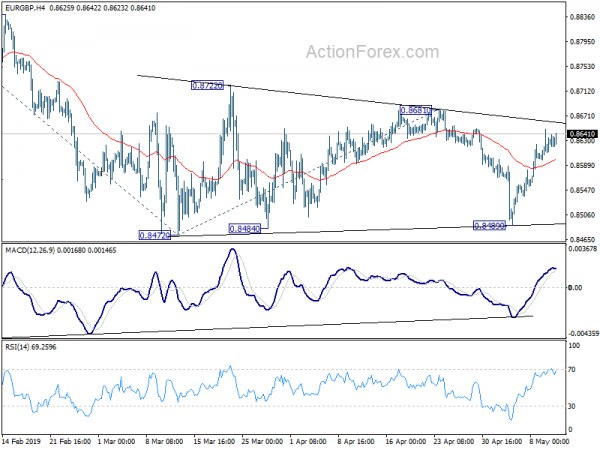

EUR/GBP rebounded strongly ahead of 0.8472 low last week. But still outlook is unchanged that price action form 0.8472 is seen as a consolidation pattern. In case of further rise, upside should be limited below 0.8681 resistance. On the downside, decisive break of 0.8472 will confirm resumption of down trend from 0.9101 and target 61.8% projection of 0.9101 to 0.8472 from 0.8681 at 0.8292 next.

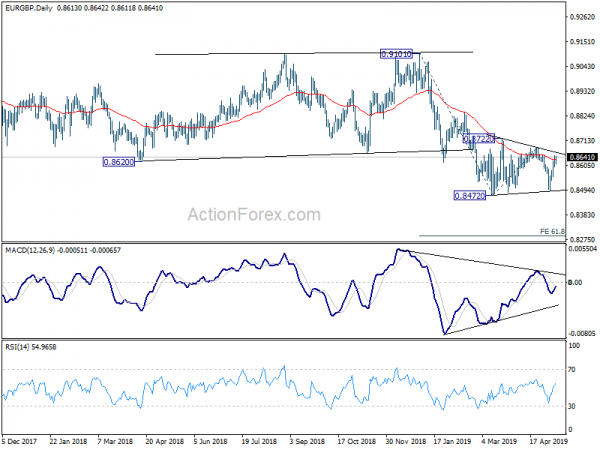

In the bigger picture, medium term decline from 0.9306 (2017 high) is seen as a corrective move. Current development suggests that it’s extending through 0.8312 support towards 50% retracement of 0.6935 (2015 low) to 0.9306 at 0.8121. We’ll look for strong support around there to contain downside to complete the correction. But for now, break of 0.8681 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of recovery.

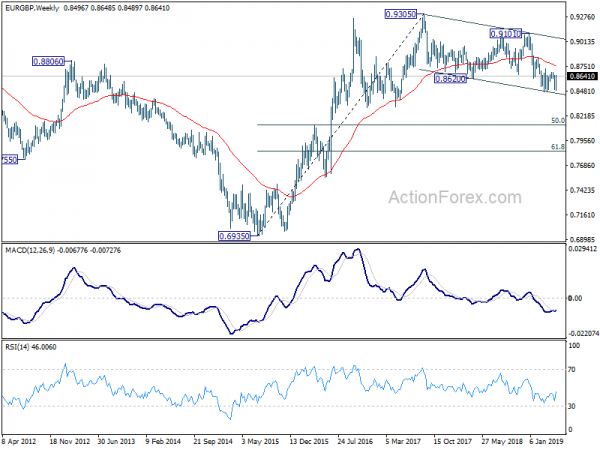

In the long term picture, we’re holding on to the view that rise from 0.6935 (2015 low) is resuming the up trend from 0.5680 (2000 low). As long as 50% retracement of 0.6935 to 0.9304 at 0.8120 holds, further rise should be seen through 0.9305 to 0.9799 and above down the road.