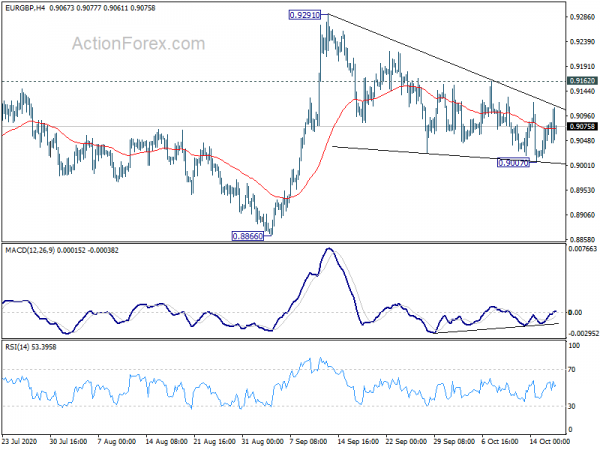

EUR/GBP edged lower to 0.9007 last week but recovered quickly again. Initial bias remains neutral this week first. The structure of the fall from 0.9291, as well as weak downside momentum as seen in 4 hour MACD, suggest that it’s merely a corrective move. That is, rise form 0.8670 isn’t completed yet. Break of 0.9162 will turn bias to the upside for 0.9291 resistance first. Break of 0.9007 would extend the decline but downside should be contained above 0.8866 support to bring rebound.

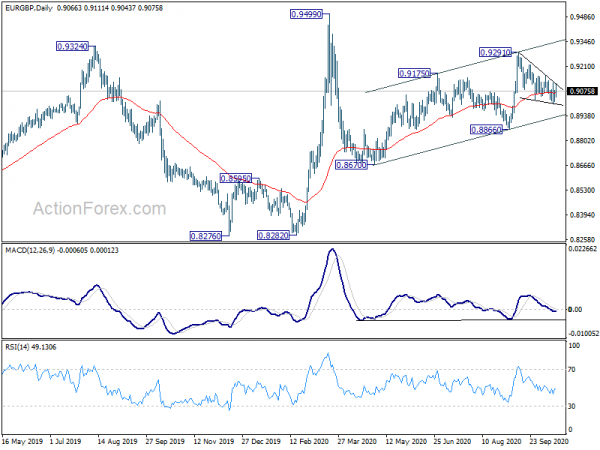

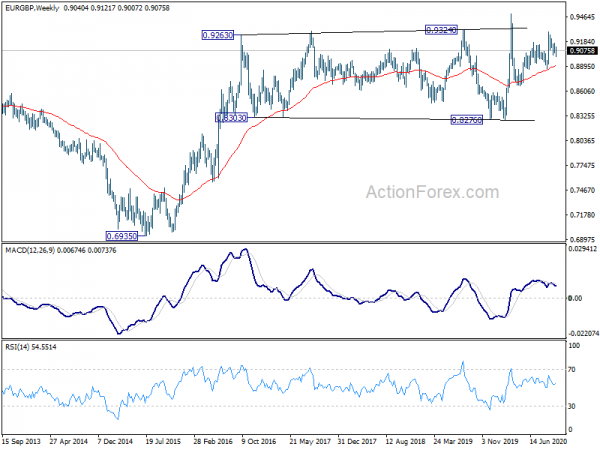

In the bigger picture, at this point, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. Decisive break of 0.9499 will target 0.9799 (2008 high).

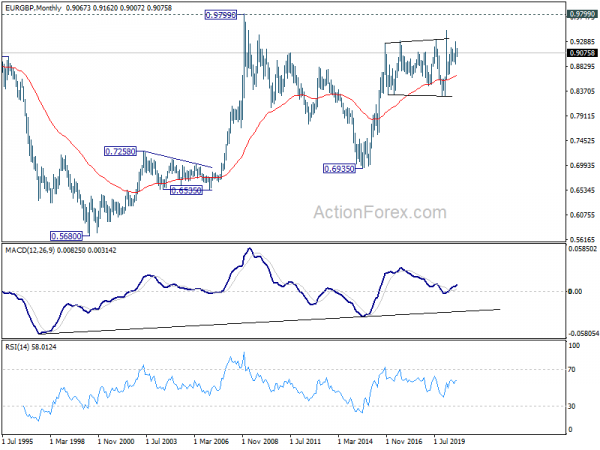

In the long term picture, rise from 0.6935 (2015 low) is still in progress. It could be resuming long term up trend from 0.5680 (2000 low). Break of 0.9799 (2008 high) is expected down the road, as long as 0.8276 support holds.