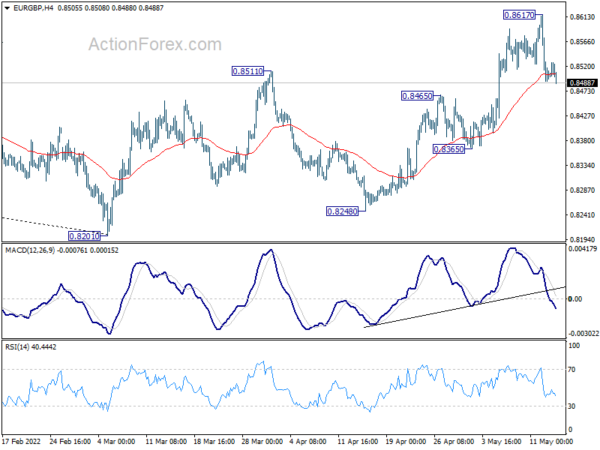

EUR/GBP edged higher to 0.8617 last week but retreated since then. Initial bias remains neutral this week first. Rise from 0.8201 is still in favor to continue as long as 0.8365 support holds. On the upside, break of 0.8617 will resume such rise to 0.8697 medium term fibonacci level. However, break of 0.8365 will dampen this bullish view, and turn bias back to the downside instead.

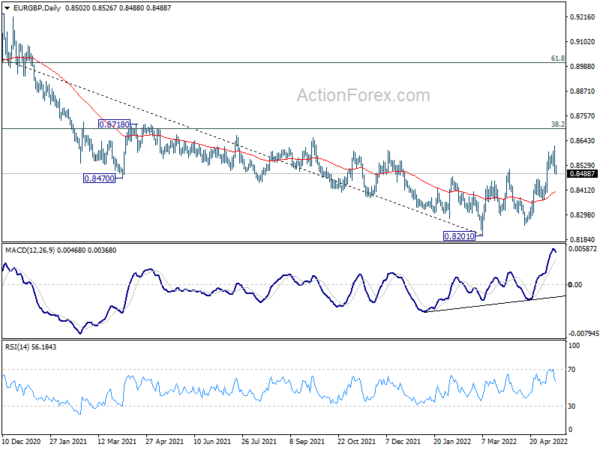

In the bigger picture, a medium term bottom could be in place at 0.8201, on bullish convergence condition in daily and weekly MACD. Rise from there could either be a correction to the down trend from 0.9499 (2020 high), or a medium term up trend itself. In either case, further rise should be seen to 38.2% retracement of 0.9499 to 0.8201 at 0.8697. Sustained break there will target 61.8% retracement at 0.9003.

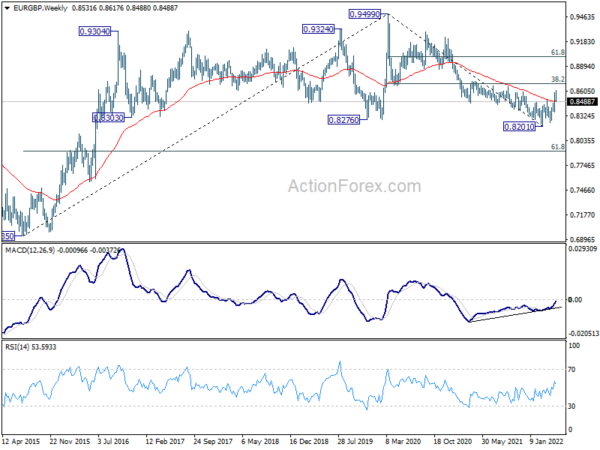

In the long term picture, current development argues that fall from 0.9499 is probably the third leg of the pattern from 0.9799 (2008 high). Sustained break of 61.8% retracement of 0.6935 to 0.9499 at 0.7917 will pave the way back to 0.6935 (2015 low) and probably below. However, sustained trading above 55 month EMA (now at 0.8604) will dampen this bearish view and bring stronger rebound.