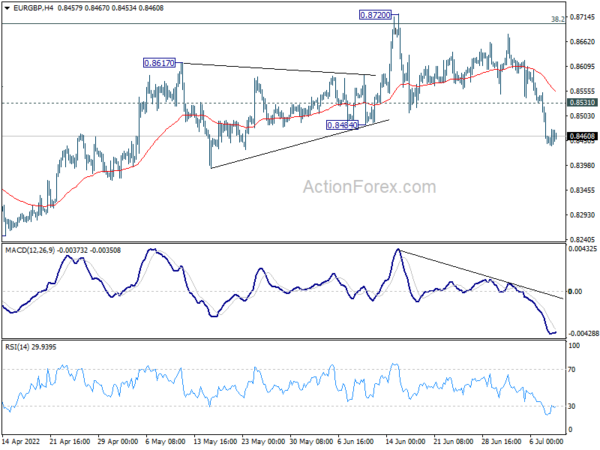

EUR/GBP’s steep decline last week argues that rebound from 0.8201 has completed at 0.8720 already, after rejection by 0.8697 medium term fibonacci level. The development maintains medium term bearishness. Initial bias stays on the downside this week for retesting 0.8201/48 support zone next. On the upside, above 0.8531 minor resistance will turn intraday bias neutral first.

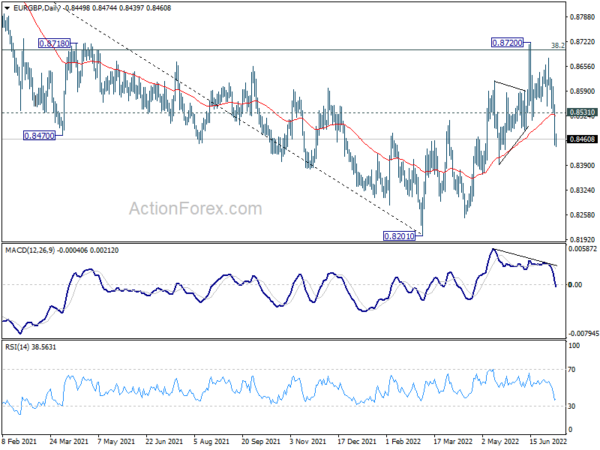

In the bigger picture, rejection by 38.2% retracement of 0.9499 to 0.8201 at 0.8697 argues that rebound from 0.8201 is merely a corrective move. That is, down trend from 0.9499 (2020 high) is now over. Sustained break of 0.8201 will resume such decline and target 61.8% retracement of 0.6935 to 0.9499 at 0.7917. This will now remain the favored case as long as 0.8720 resistance holds.

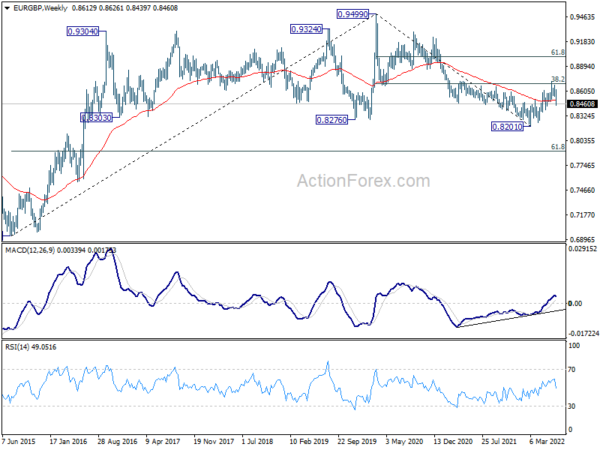

In the long term picture, the lack of medium term downside momentum suggests that fall from 0.9499 (2020 high) is merely a correction to rise from 0.6935 (2015 high). In case of another fall, downside should be contained by 61.8% retracement of 0.6935 to 0.9499 at 0.7917 to bring rebound. Sustained trading above 55 month EMA (now at 0.8604) will indicate that the correction has completed and bring retest of 0.9499.