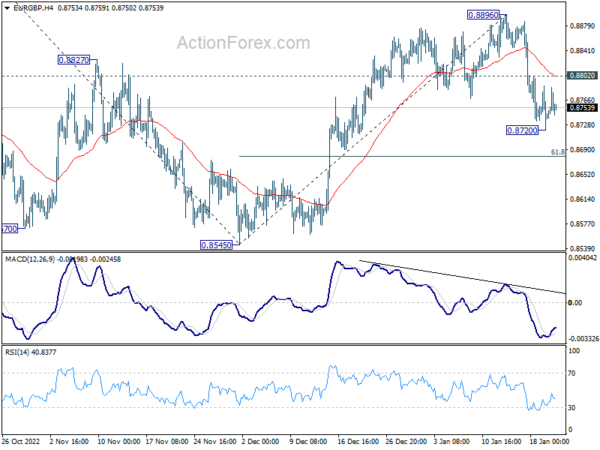

EUR/GBP dropped sharply to 0.8720 last week but turned sideway after hitting 55 day EMA. Initial bias is turned neutral this week first. On the downside, below 0.8720 will resume the fall from 0.8896 to 61.8% retracement of 0.8545 to 0.8896 at 0.8679. Sustained break there will pave the way back to retest 0.8545 low. On the upside, though, above 0.8802 will bring retest of 0.8896 resistance.

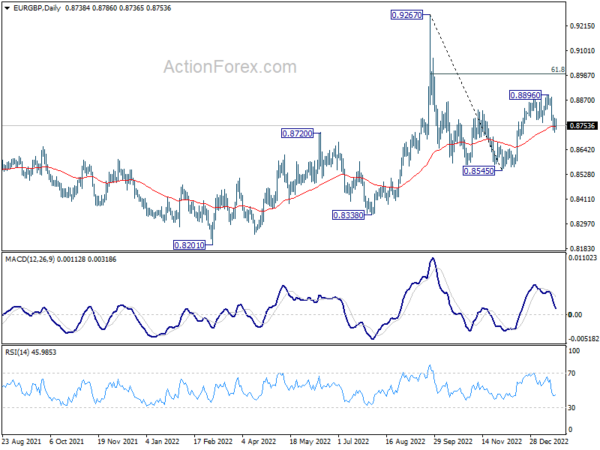

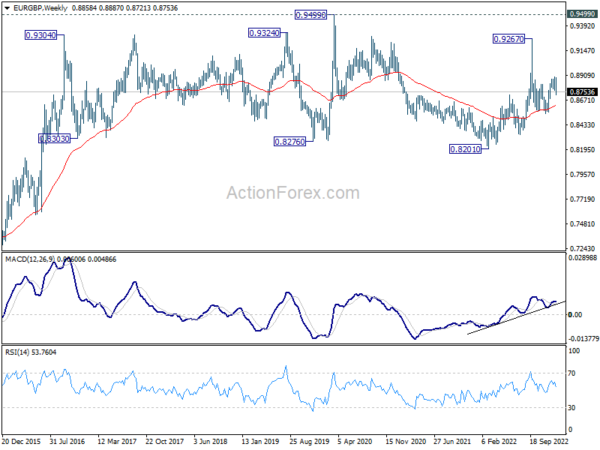

In the bigger picture, current development argues that rebound from 0.8545 is merely a correction to fall from 0.9267. Sustained trading below 55 day EMA (now at 0.8748) will affirm this bearish case and target 0.8545 and below. Nevertheless, strong rebound from current level will retain near term bullishness for another rise through 0.8896 later.

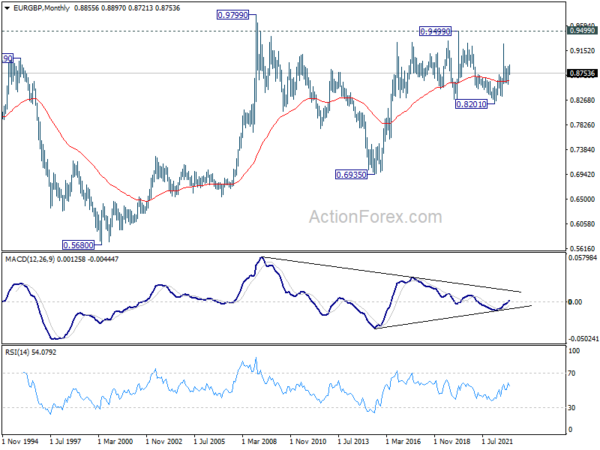

In the long term picture, long term range pattern is extending. But rise from 0.6935 (2015 low) is expected to extend at a later stage, to 0.9799 (2009 high).